Forex strategy for Q1 2026:

A STRATEGY BLOG BY MUFFETT INVESTMENTS- 20/01/2026

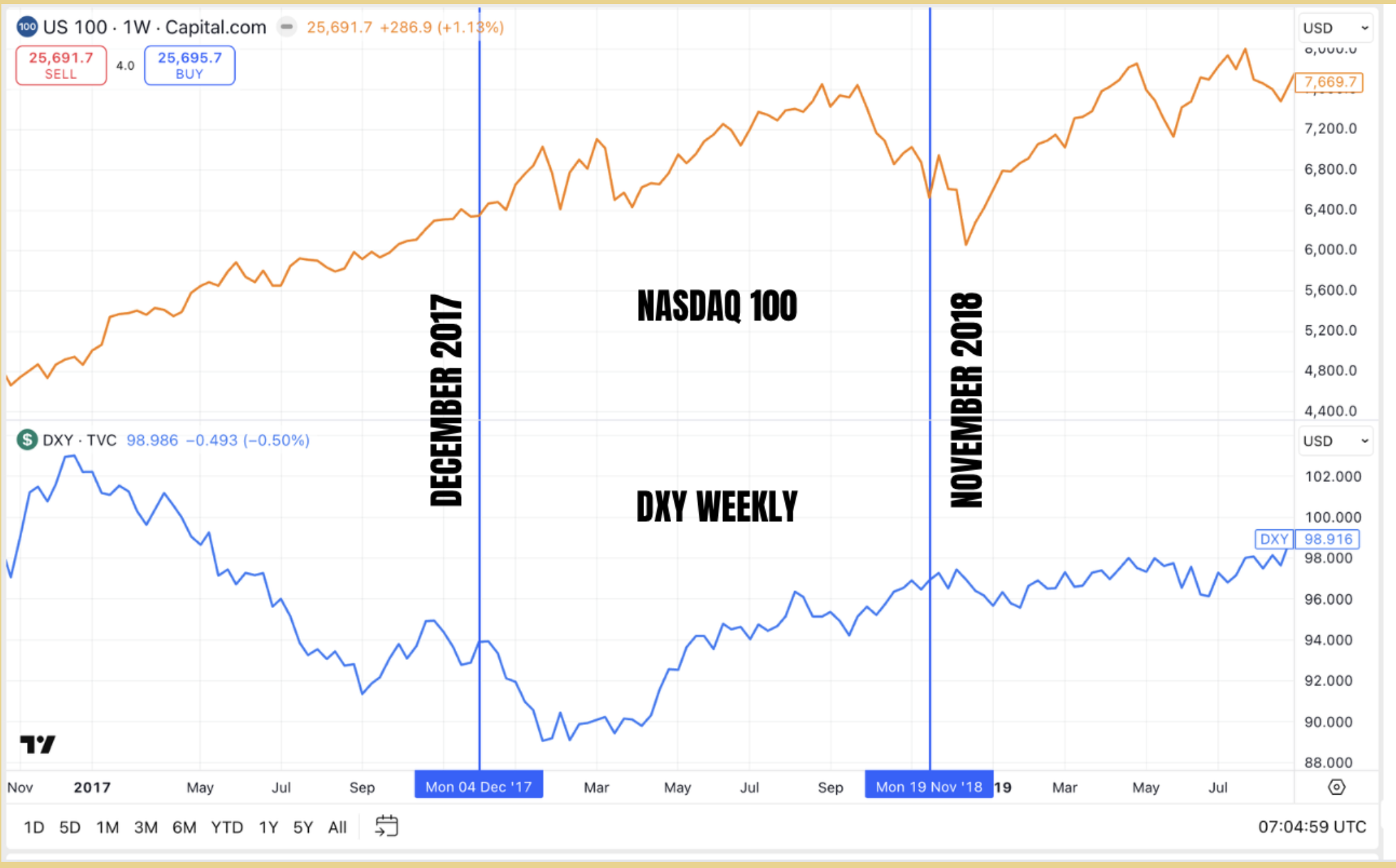

We have shared this chart in a previous post. This is the performance of DXY in 2018 during the midterm election year of President Trump’s first term in office. As you can see the DXY made a low in March and rallied higher into the November midterm elections. There are many reasons why a similar scenaria might play out.

First, the DXY is already down more than 10% since Trump took office. A falling dollar is inflationary and when it rises into the election, it might take some of the edge of the inflation. In our view, Trump will do all things possible to make sure that the Republicans win the Midterm election and in our view, he is on course to win the Midterm election contrary to many analysts.

We are also in a exaggerated geopolitical situation. Not only is USA waging an economic war against China and Russia, It is also engaging in redefining the global order. He is making countries choose between USA and China and also inorder to make USA stronger, he is also fighting his allies with regards to Greeenland. This could easily escalate into a full scale economic war if this cant be resolved quickly through negotiation.

But most important of all, we think that US action on Iran to effect a regime change is potentially dangerous and if things do no go to plan and Iran is able to damage the oil infrastructure in the middle east or if the Iranian regime manages to survive, then this could have significant geopolitical problems and escalating oil price. This increased oil price is actually DXY positive as the Euro, GBP and JPY which constitute an important part of DXY are all oil importing nations. We also think that Trump might be underestimating the resilience of the Iranian regime and so engaging with Iran is fraught with serious risks.

If you have been following us, we were expecting a move lower followed by the move up. But price has moved above our resistance zone. Thsi now becomes support. We have marked the liquidity levels of the last quarter. As long as price is above the support, we look to target the liquidity above the equal highs at Q4 high. If price goes below the support, then price can take the liquidity below the Q4 low.

In our view, we may have a false move first and we need to wait and see how the market makers set the trap. so we are waiting. But the above analysis based on Liquidity stands good.

In view of the imminent attack on Iran, we think that the DXY is more likely to head higher, together with higher gold and higher oil until such times as the situation in Iran settles down.

May the peace of the Lord be with you all