African demographics suggest that it is the next frontier for strategic investors:

An investment blog by Muffett investments- Feb 2027

At Muffett investments, we are always looking for the next big strategic investments. In our 2026 high conviction ideas, we have pointed out growth in Africa as a megatrend. Here we present some of the reasons as to why we believe that companies with significant exposure to Africa would outperform in the coming years. Indeed the African growth story is a megatrend on par with the AI megatrend and might become even more relevant in the coming decade.

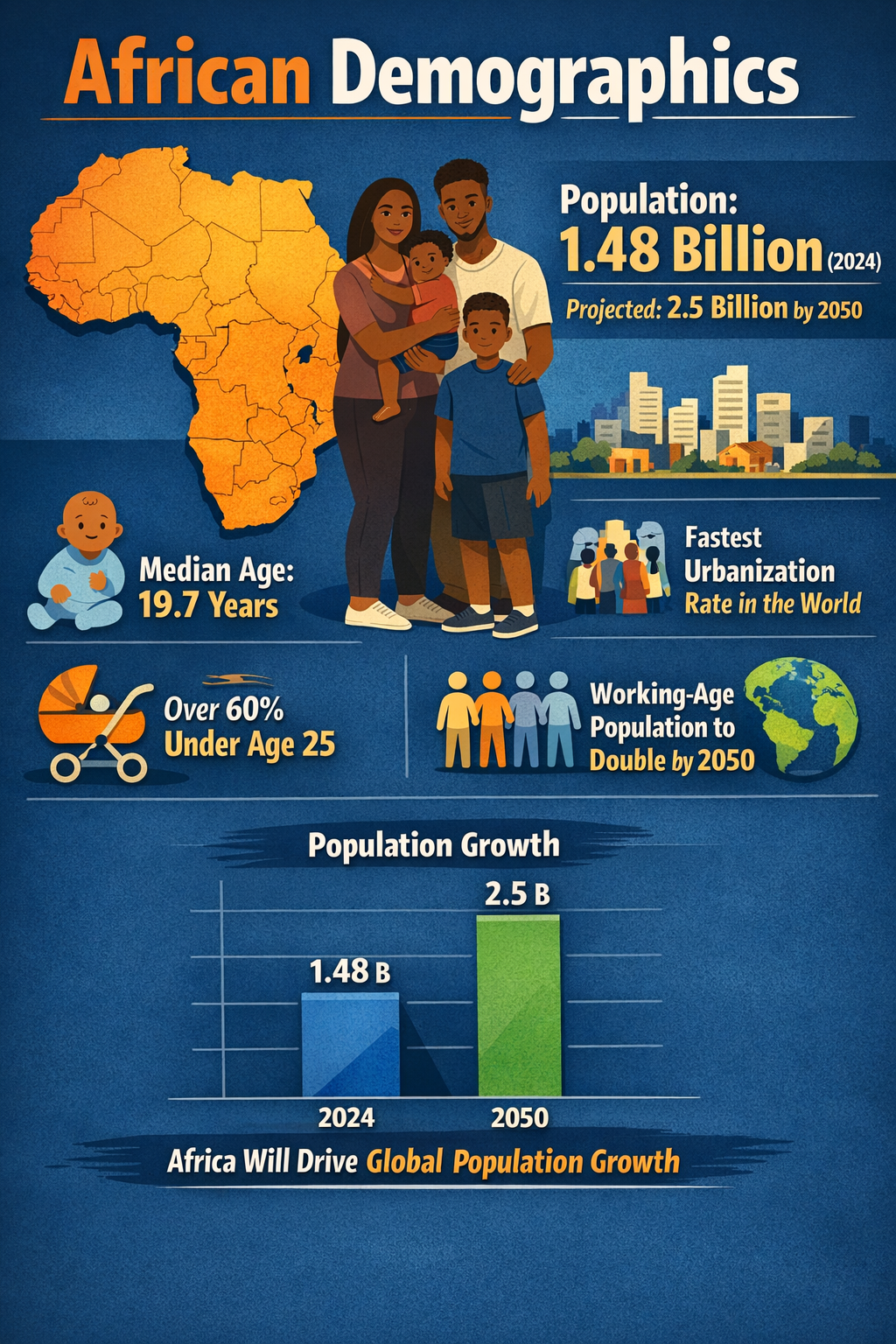

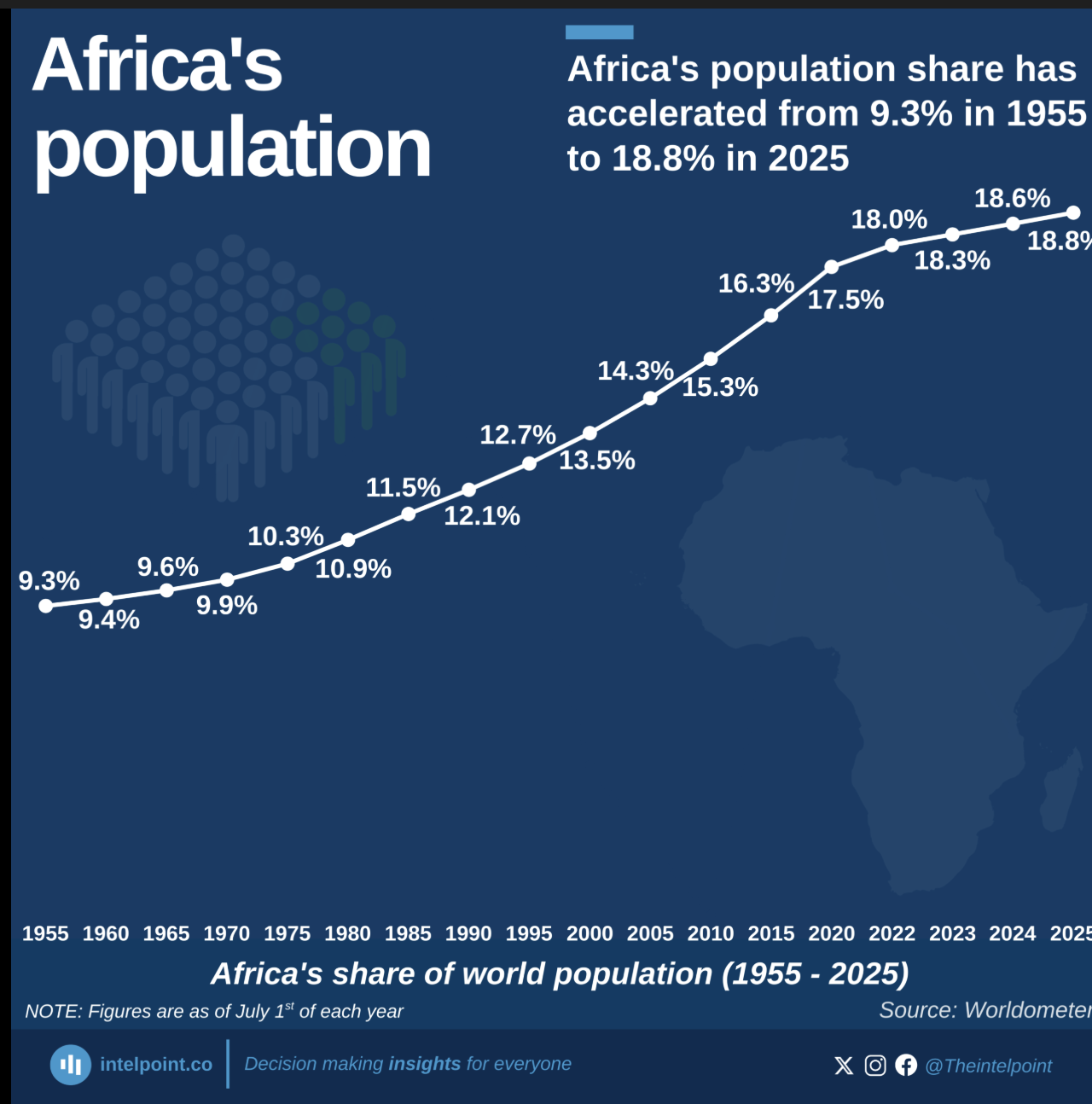

As shown in the slides presented, African population is projected to grwo to 2.5 billion in 2050 and Africa’s share of the world population is nearly 20% now and one in four person on earth will be in Africa by 2050. Also as shown in the slides the population is young with the working age population is projected to double by 50%, Currently 65% of the population is under 25 years. This means that the pool of people in the working age and increased age is going to be highest in Africa in the coming years.

we think that as the West ages and the economies become sluggist, Africa will be a shining beacon with its demographic dividend and will contribute to a significant proportion of global growth and consumption in the coming years. So the companies which are exposed to the African markets would benefit from this megatrend.

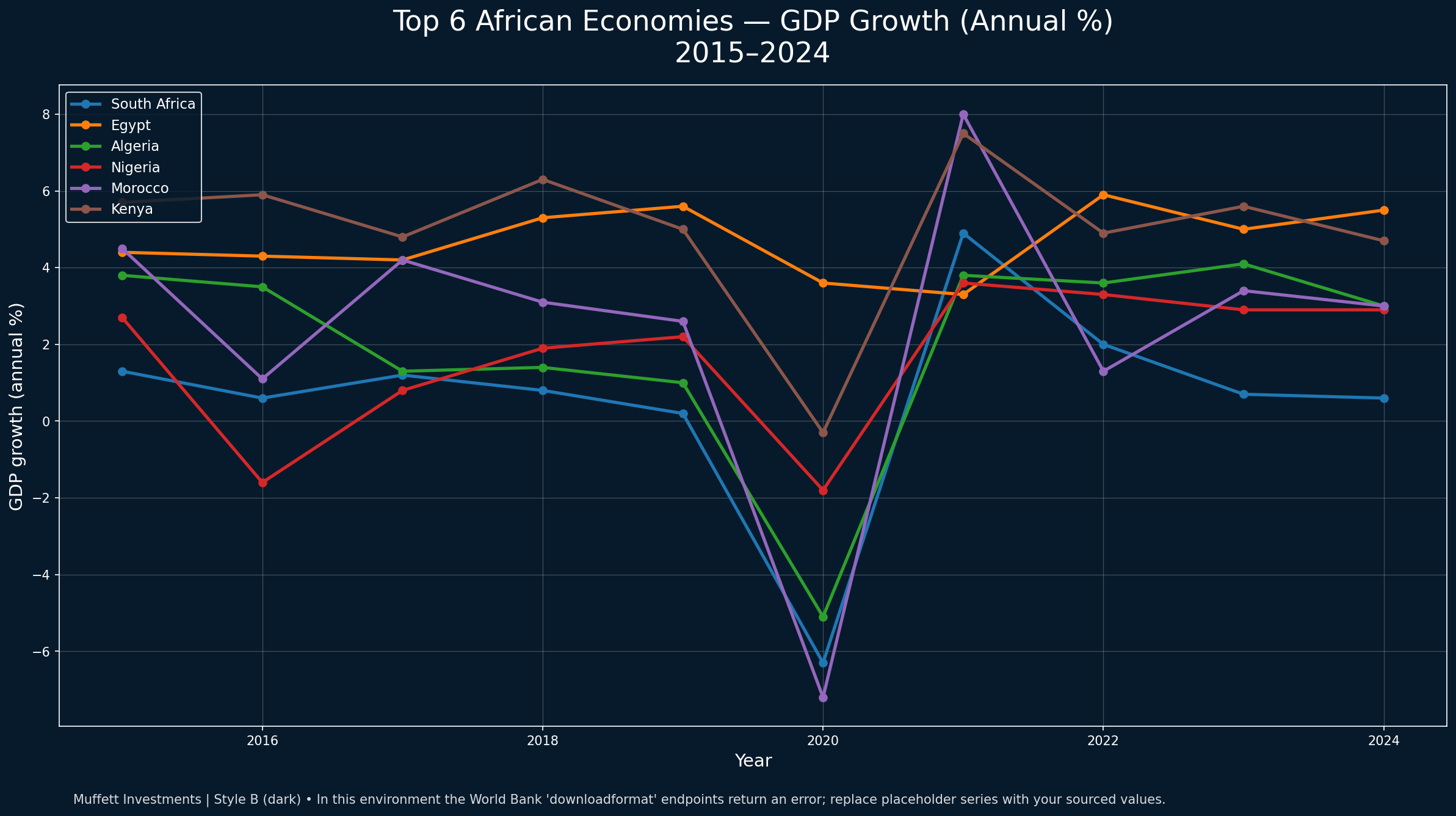

This is a line chart of the GDP growth rates of the biggest economices in Africa. Many of them are on average growing at about 5% per annum. some of the smaller economies are growing at even higher rates. As the countries start to grow after coming out of the shackles of colonialism, we predict that the growth rate will accelerate further as major infrastructure projects are completed. It is not just demographics that is an advantage but also the resources that Africa has that increases its future potential. Also starting from a low baseline means the eocnomies can keep growing at a fast rate for long periods of time.

Belt and road initiative and Africa:

The belt and road initiative by China which started in 2013, has meant that hard to find financing for infrastructure projects has now been found and no matter the underlying motives of China for the BRI, we think that once these projects are completed it would lead to increased economic activity and accelerate economic growth. It is estimated that more than 200 billion dollars have been invested in Belt and road initiative projects across Africa since it started. In 2025 alone more than 60 billion dollars in deals have been made through this initiative.

These infrastructure projects in our view will boost trade between the African countries and also boost trade with the world. With geopolitical fragmentation of the world, the resources of Africa will become a key strategic imperative for both the blocs. So there is plenty to be optimistic about Africa.

How to get involved?

The easiest way to get involved in through ETF. Examples include ticker symbol AFK, EZA and FM.

Although EZA( south africa ETF) is outperforming , we like AFK better which gives a more pan African exposure.

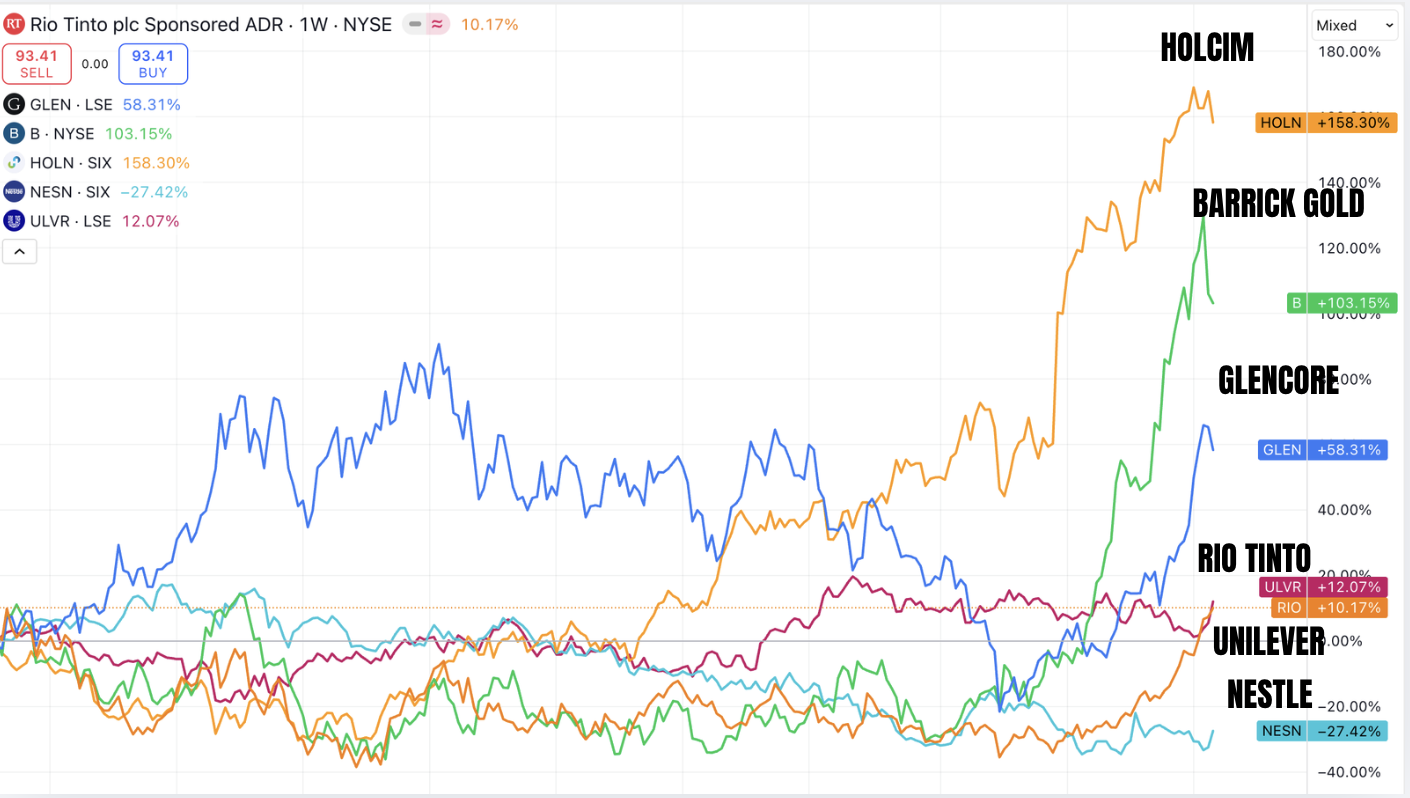

Another way to get involved is through commodity producers involved in Africa and companies which can benefit indirectly through exposure to African growth. All these companies are exposed to Africa and we think will benefit from African Growth.

Analysis done in good faith and not investment advice.