American imperial strategy - Venezuela

Energy has defined human civilisation and all modern economies are very dependent on energy. Energy security is one of the key strategic objectives of geopolitical rivals. For a long time, American imperial strategy on energy has relied on securing the middle eastern conduit for oil by maintaining the American 5th Naval fleet in the Persian Gulf. Also after coming off the gold standard, the US dollar was backed by oil (the petrodollar) after they negotiated security guarantees with Saudi Arabia in exchange for it to sell oil in US dollars. This meant that all countries were motivated to have US dollar reserves to buy oil. Any attempts by oil producers to sell in other currencies in an attempt to diversify has been dealt with by regime changes (Iran and Libya) in order to maintain the petrodollar system(This is widely believed in non western world)

However the rise of China and the increasing use of financial sanctions to enforce American foreign policy meant that countries were incentivised to evade the sanctions using alternative payment methods. And Venezuela was one of the first countries that was motivated to evade sanctions after President Obama and followed by President Trump imposed sanctions in a bid to topple the Maduro government. But Maduro found ways to evade sanctions through the following means.

Using obscure intermediaries and rebranded cargo( posing as Malaysian and Russian crude and using ghost tankers to do crude trades. This same method was later used by Russia to evade sanctions in 2022

Barter crude for food and other refined products

Gold for cash trade - Illegal mining of gold in the Orinoco basin and using the gold to get hard currency through 3rd party countries like UAE and Turkey

China using the Belt and Road initiative gave lot of loans to Venezuela and was able to get discounted crude in return for loan repayment.

Venezuela also used cryptocurrencies to bypass some of the sanctions.

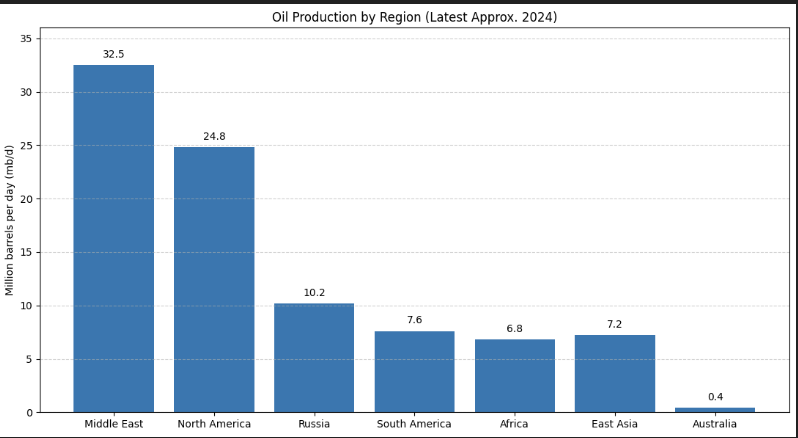

Also as the shale revolution grew and American oil production started to increase, American strategy towards the middle east started to change. Although they are the biggest oil producer, they still need to import oil to meet their needs. This is met mostly by Canadian and also oil from South America . American refineries in the gulf coast need sour heavy oil crude as input which is produced in Canada and Venezuela. With production increases in Canada and Venezuela, America does not need Middle Eastern oil. So the strategic importance of the middle eastern oil has diminished although the petrodollar was still needed for the dollar to be the reserve currency.

As trade tensions increased between China and USA , China has increasingly tried to undermine the US dollar. The current strategy is to develop alternative payment system to bypass SWIFT, which has been increasingly weaponised by the USA. Another strategy is to use Yuan as a method of payment for oil trade between middle eastern countries and China. To this end, china is building gold vaults in Singapore and Saudi Arabia and negotiations are being made between the oil producers and china to use Yuan as a medium of exchange for the dollar. China has also been hoarding gold and its unofficial reserves are nearly 20,000 tonnes which is more than the combined G7 holdings. Whenever America sanctions a country, China negotiates a deal with the sanctioned country and gets good deals with them. Example include Russia and Iran. So when you have a strategic rival, imposing sanctions is not a good idea as you are pushing them into the hands of your rival.

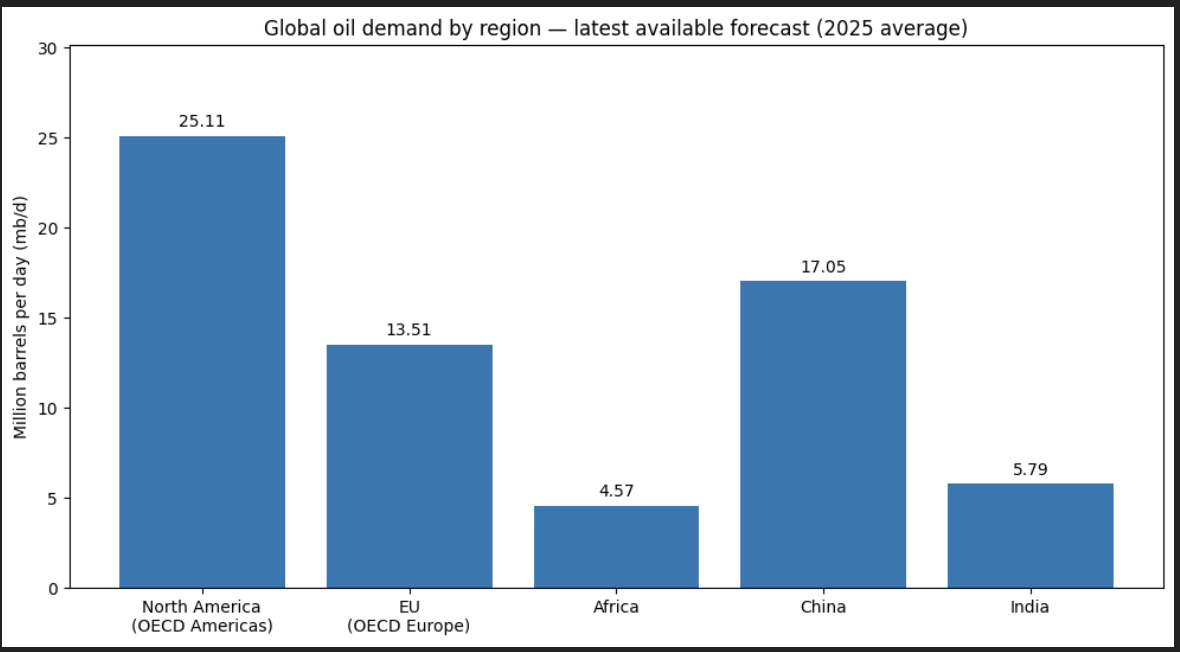

If we look at the total crude oil output and the crude oil demand, we can see that America and its EU allies need approximately 38 million barrels of crude. The North American production is about 25 million barrels and South American production is about 7 million which can be increased if sanctions can be removed from Venezuela and investments made into the oil sector. This should ensure not only American oil security but also that of EU. If needed they can secure African oil if there is any disruption in output in any of the fields in North and South America.

As more and more of the Middle Eastern crude goes towards China and Asia, there is a strategic case for the Middle Eastern countries to align themselves with China. The reason for opening a gold vault in Saudi Arabia, is to enable crude to traded in Yuan which is backed by gold held in the vaults. We think that negotiations are being made to get this implemented.

So the missing link in NATO energy security is Venezuela. If Venezuela can be brought under American influence by dethroning Maduro and replacing it with someone who is more aligned with America, will mean that American oil majors can enter into Venezuela and do the necessary investments to raise the crude oil. Also remember the heavy oil from Venezuela is the best crude for American refineries in the Gulf coast. Also we speculate that the Stabroek block off the coast of Guyana is very close to Venezuelan waters. We speculate more oil finds in the Venezuelan waters. If this were the case, the economics of these oil fields are great and maybe similar to the Stabroek block where the production cost could be as low as $13.

This is why we think that Trump is trying to dethrone Maduro. If Maduro does not fall easily, then Trump might be forced to send armed troops into Venezuela in an attempt to arrange a coup. This is very risky which is why we feel that Trump is reluctant to do this. We would like to remind the readers that there are several assumptions made and some of the assumptions are speculation on the part of us and is not backed by facts but we think that the speculation is plausible.

If Venezuela can be brought under American control, then we need to brace ourselves for a more open confrontation between America and China. America will no longer need to maintain the 5th fleet in the gulf. They can even engineer local conflict and block the passage of crude through the Persian gulf. This is an economic weapon against China as it needs the Middle Eastern oil for its energy security. A situation like this will cause significant escalation in the price of oil.

This is the reason why we recommend that all portfolios should have exposure to oil. Exxon Mobil is the best oil play as it has low leverage and has exposure to the biggest oil field Permean basin, Stabroek block and also have down stream operations like LNG players and refineries.

We also like Equinor as it is a strategic producer of natural gas for the EU. Europe imports a significant portion of its LNG from the middle east.

May peace be with you all.

Disclaimer: All are Muffett’s own opinion and some of the ideas are speculation. This does not consitute investment advice.