2026 outlook - DXY & currencies edition

The mind wonders and then comes up with a solution. Most are done during sleep after a problem has been put into the mind and various solutions are pondered and finally coming up with the solutions. The solutions may not always be right but leads the man in the right direction.

It is our view that unless you wonder and speculate what is going to happen in the future, there is no clear edge in the markets. As we practise wondering some of the things get easier and we can create a framework upon which we can build ideas. Now some of our analysis for the next year are going to be speculative because we do not know.all the facts. Predicting the future is about trying to come up with probable outcomes based on the known facts. Sometimes as we move along time, new facts emerge and we should be able to adjust our expectations of a said outcome in the light of the new facts.

With regards to currencies, we know that the Trump administration wants a weak dollar. We also know that to enact their agenda, they need to win the midterm election. While many are speculating that Trump will lose the midterm, barring a war in Venezuela or some other silly misadventure, we predict that Trump will win the midterm elections. The Trump team would do anything within their reach to achieve that. And for that to happen, we need weak oil price and a higher dollar. Both will address the cost of living crisis to a small and meaningful extent. As the dollar is already down 10% in the first term, we predict that the dollar will rise during the second year.

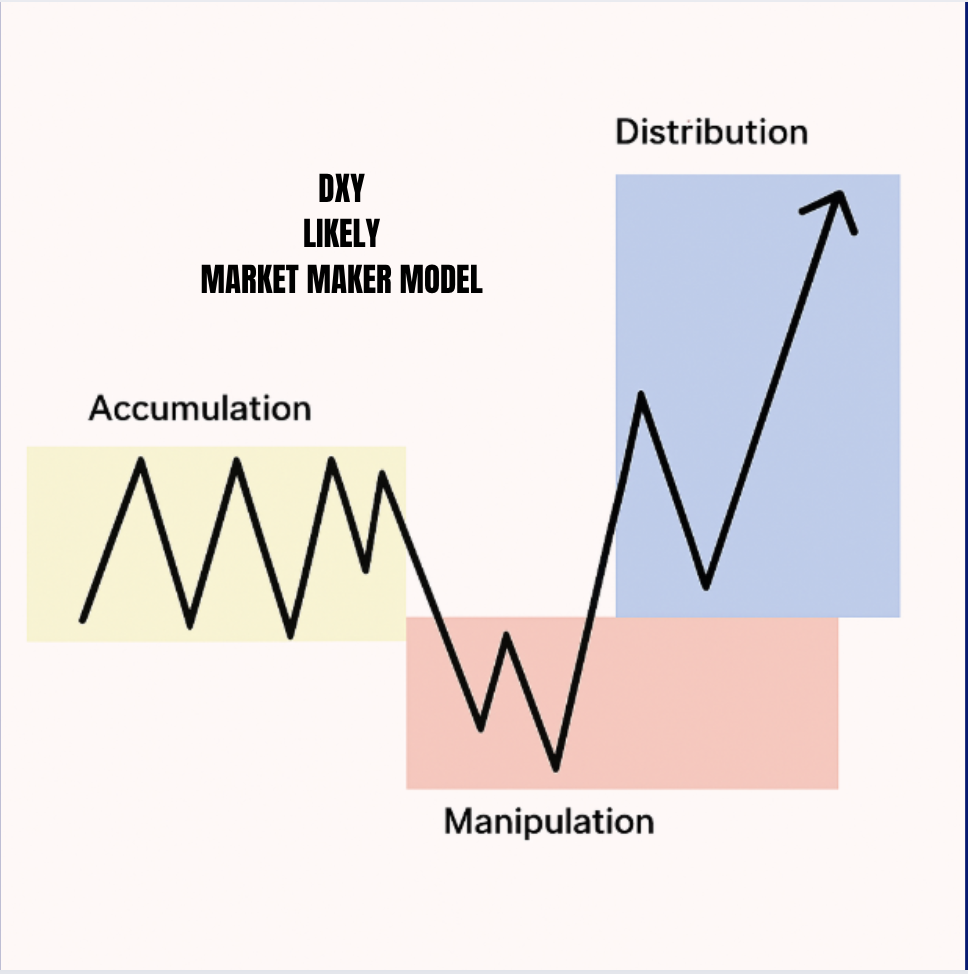

When we look at the DXY chart, we can see conditions ripe for a big move. The dollar has been in a broader consolidation for the last 2 quarters. During this time, the market makers have accumulated a lot of positions. We speculate that this will be mostly long positions. A lot of negative sentiment has already been engineered for the dollar. So next year we speculate that the market makers will do a AMD pattern for the DXY. They will engineer a sudden big move to the downside and engineer a bearish view on DXY to the market participants. They will then move the market in the opposite direction in a slow and grinding manner above the consolidation.

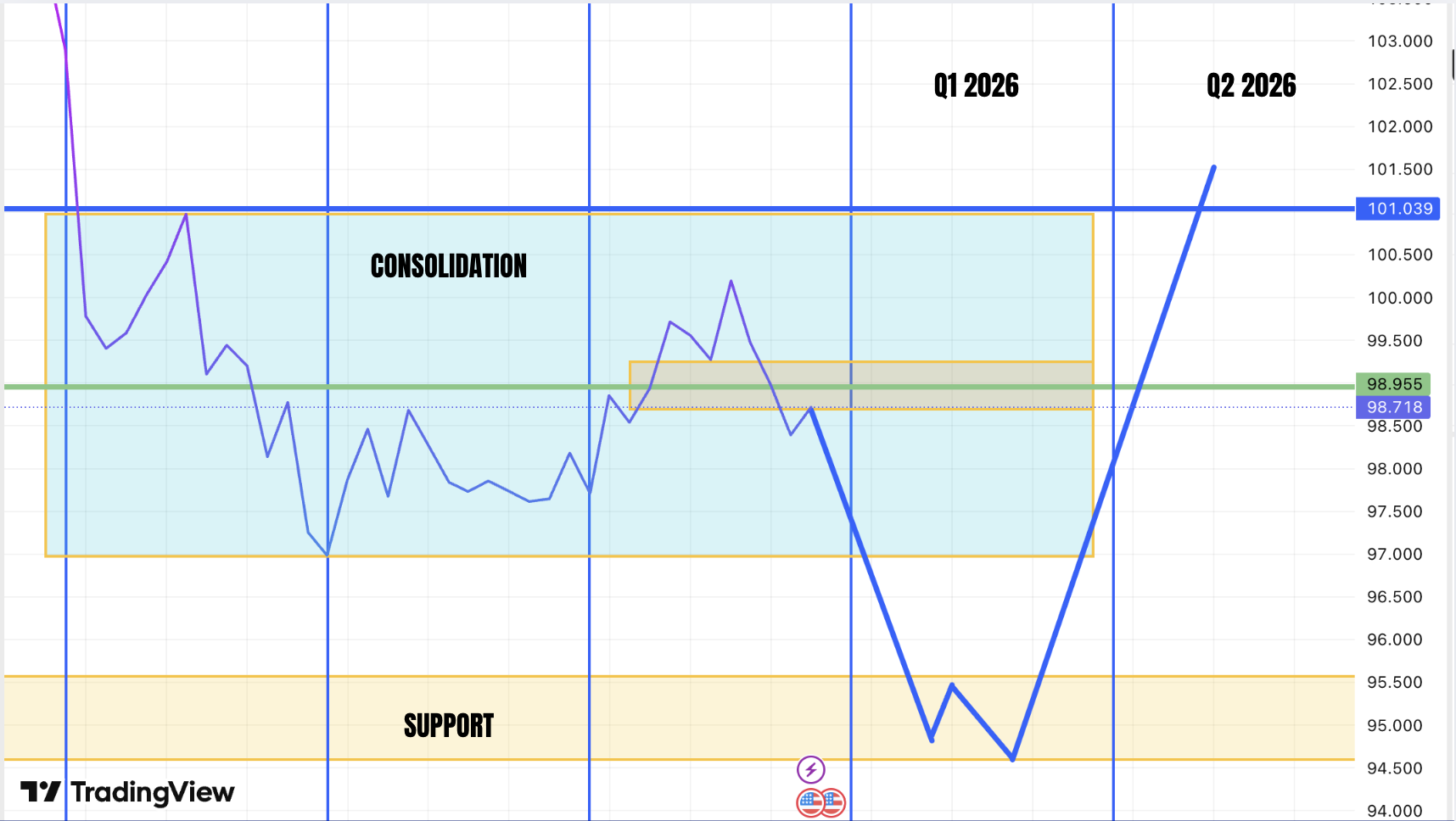

Here we present the DXY grid map with the most possible scenario for DXY into the first and second quarters of 2026.

The above is the weekly chart of DXY. We have divided the chart into quarters. As you can see after a big fall in Q1 and Q2 of this year, the price has been in consolidation for the last 2 !/2 quarters. We have marked the range highs and range lows. Below this consolidation is a support zone which has been derived from the monthly chart. This is a classic market maker trap set up. The price is accumulated above a key level and then the price is manipulated into the key level and the liquidity has been engineered during the consolidation. This liquidity is what they need before the big move up. This is our preferred scenario. If you look at Trump’s first term, this was the scenario that we had. A big fall in the dollar during the 1st year followed by a rise in the second year. He may be playing from the same playbook.

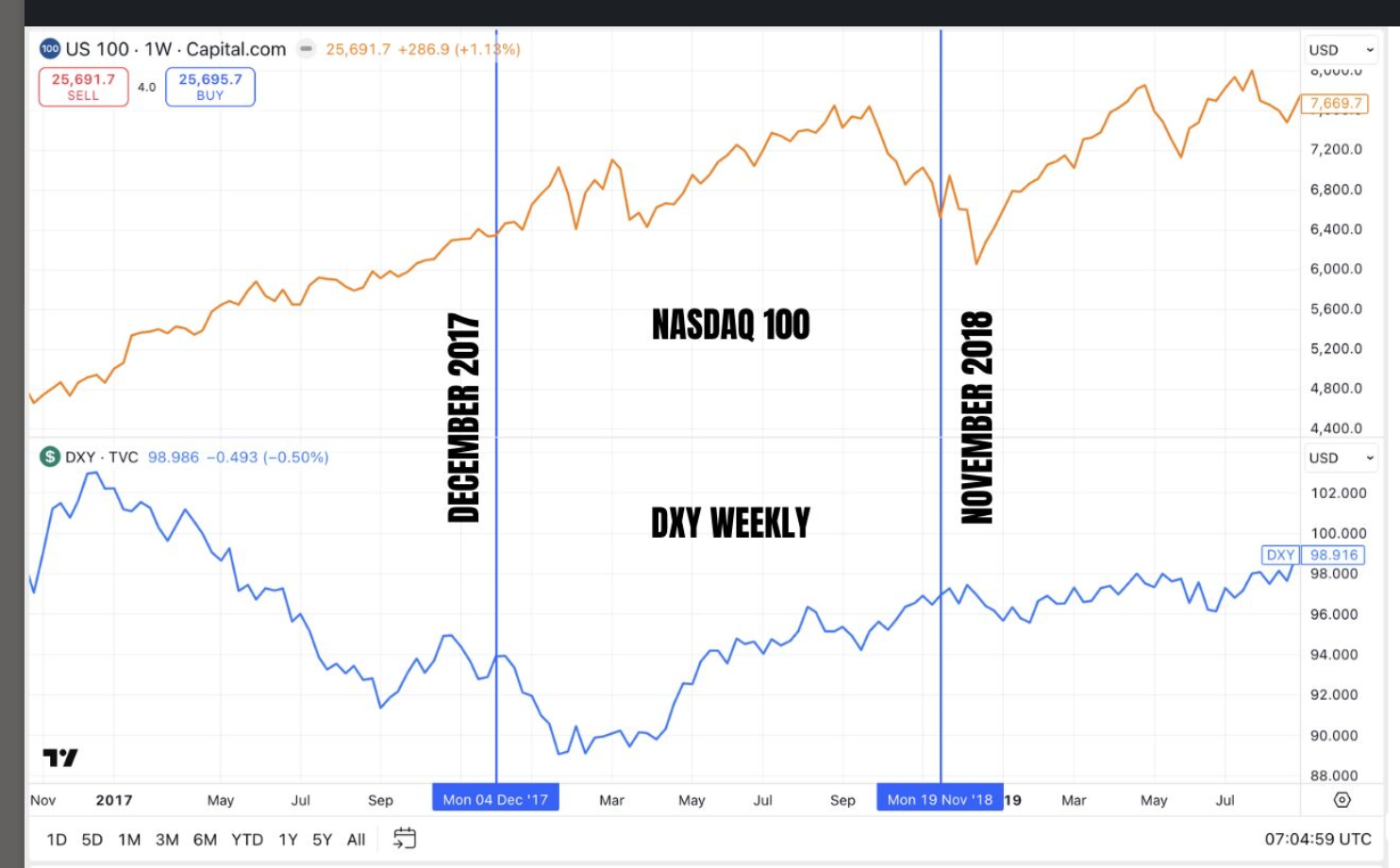

The above is the performance of Nasdaq and DXY during the second year of Trump’s first term. You can see that the Nasdaq rises until september before a big fall into the end of the year. The DXY however makes a low in the first quarter and rises above the July 2017 high by the time of the midterm elections.

The above is a market maker schematic of accumulation, manipulation and distribution (AMD pattern) pattern of a market maker model. So if our premise is right, we will have a manipulation down followed by a move up which will end in the DXY taking the high of The consolidation which is May 2025 high.

Our prediction model relies on the market makers moving the market to areas of liquidity. Another scenario could be the price to be manipulated up to take out the high of the consolidation before the second quarter followed by a move lower down into support. We think that this scenario is less likely. We will be watching the resistance drawn (orange shaded area within the consolidation) and as long as this is not overcome, we think that price will continue lower.

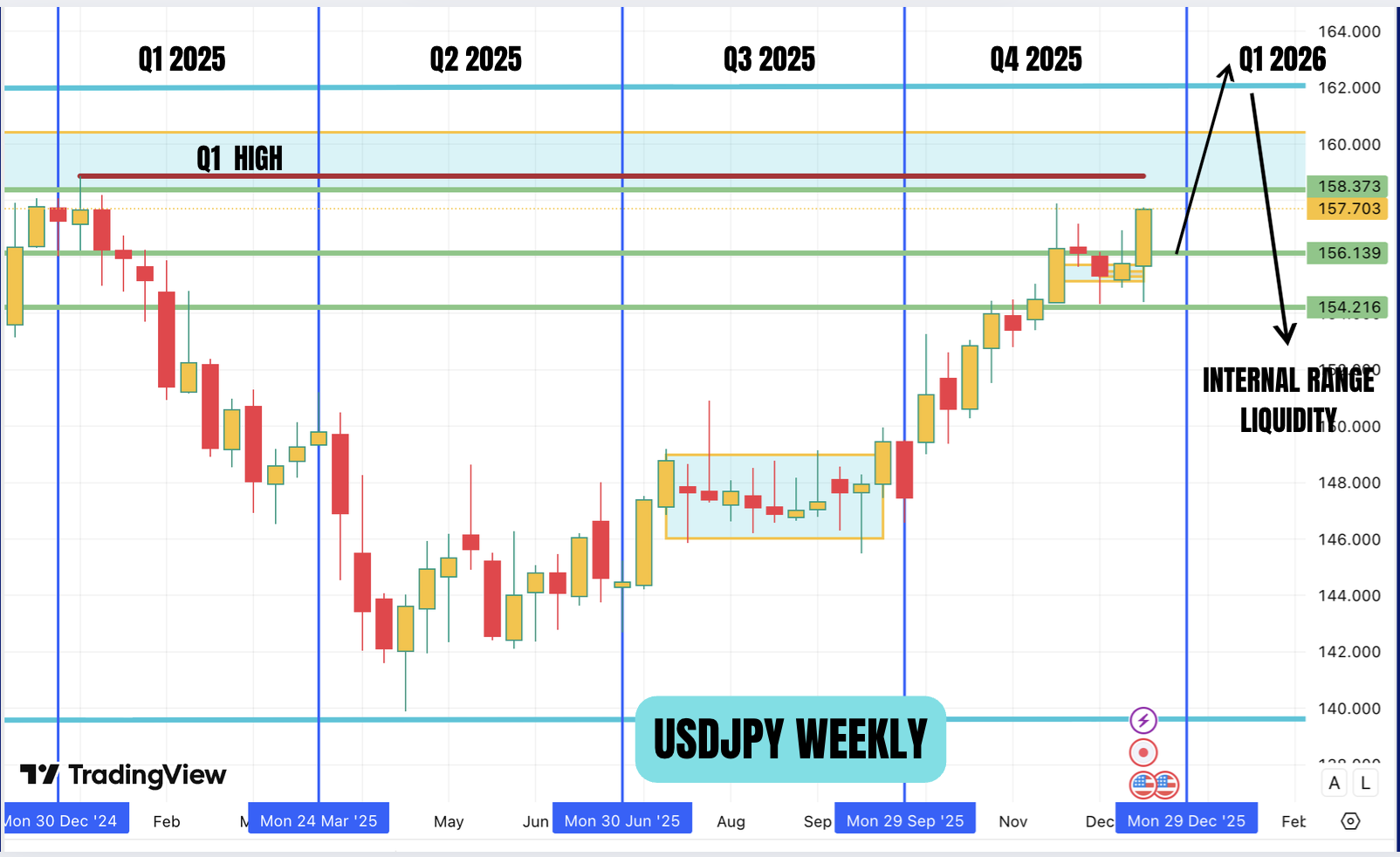

While the DXY has fallen 10% the JPY has remained essentially unchanged> As you can see from the weekly chart, USDJPY will take out Q1 high soon. Earlier this year, we pointed out the divergence between DXY and USDJPy which enabled us to take longs on USDJPY. It is surprising considering that Trump wants a weaker dollar. Our presumption is that Trump is allowing that because he knows that it is keeping the US markets at frothy levels from carry trade. The US needs capital and if the stock market drops, the capital will move out of US. This is one reason why we think that all attmpts will be made to keep the market rising. However as the JGB yields start rising, it will be very difficult a sustain a move higher. WE think 162 is likely to be top of the move followed by a move to 154.

The above chart compares the yield spread between the 10 year yields of US and Japan with USDJPY. We can see that the USDJPY price closely follows the the yield spread. However we are seeing a divergence recently. The yield spread is narrowing but the USDJPY price is moving up. We think that as long as the US capital markets are buoyant, the carry trade can still be profitable with narrower yield spread. However if the US markets fall, then USDJPY can fall with it. Judging by the Trump's first term, we can expect the markets to perform well until at least September.

All the above are based on certain premises and we try to connect the dots based on the assumed premises. But if facts change then the assumed scenario’s may not play out. We are speculating that Trump has total control over the markets ie the DXY and Nasdaq. But if external influencers affect Trump’s ability to control the markets. We think that the US markets will continue to move higher as long as the Emperor has new clothes to wear. We speculate that the bubble will be popped by an external influence (most likely China) and until then the US stock market will be an Emperor.

May the Peace of the Lord be with you.

Disclaimer: These are all Muffett’s own views and are not investment advice.