Trump’s radical plan and gold’s surge:

As i sit down to write this blog, i checked the US debt clock. This is the link if you are interested to check- https://www.usdebtclock.org/. When I checked the figures, the US current debt is $37.8 trillion. When the previous US administration left, Janet Yellen , the then treasury secretary had been issuing plenty of paper with short expiration to take advantage of the lower interest rates in the shorter end of the curve. Now by all means i am not a yield curve expert and my blog is on a related matter. But suffice it to say that because of this, each year the US has to issue $9 trillion to refinance maturing debt and fund the deficits. So the US administration has a big problem. Trump came into office promising to cut taxes and boost the economy. But the constant funding needs of the treasury meant that the market was supplied with huge amount of treasury bills causing the rates to rise. The debt repayment outlays became more than the budget of the military. The US not only had twin deficits and hollowed out industrial base, but its empire status was being challenged by a rising China. This became glaringly obvious when US and other G7 nations imposed the most severe sanctions possible against a nation against Russia for invading Ukraine. In my view, Biden truly believed that he could bring Russia to its knees within weeks by imposing the sanctions and seizing Russian assets. But he had failed to account for the growth of China and to a lesser extent India. Putin was able to withstand the sanctions by selling oil to China and India. He also used Russian reserve gold as collateral to withstand the sanctions.

When Biden seized the Russian assets in the hope of bringing Russia to its knees and failed, the trust in the US dollar was severely undermined. At any point of time, the US and its allies can potentially seize the assets of a nation state. The global south countries needed an alternative asset that could be used if sanctions were imposed. They started to diversify some of their holding into gold. The US dollar reserve currency and the control of the SWIFT system gave US and its G7 allies extraordinary privilege. If we were to use game theory and all the nations in the world as participants, then the US would always win the game because of this privilege. So countries always played by the rules set by the US. However when Russia proved that it could withstand the sanctions, the aura of invincibility was lost.

The above is the background upon which the article is going to branch out. All of the following are hypothetical and speculative and is not based on facts. It is based on game theory application of the current geo-economic conditions. It is an attempt to explain the current rally in gold and speculate on how far the price can go. This is done based on Muffett’s belief and should not be construed as investment advice. Also this post is not political and the focus is on the investment thesis around gold. It is our belief that the rivalry between US and China will be fought on multiple fronts but principally economic. If there is direct conflict, then it will end in a nuclear war and the end of the world. On this basis, each will try to cause collapse of the other by economic means and make then accept defeat. It is important to realise that the Chinese government also has signficant debt equalling that of the US. But this debt was built up to develop infrastructure and support for key industries which the CCP has deemed as strategic. They also run a huge current account surplus.

The 4 key elements of Trump’s plan:

1.Negative real interest rates:

Trump has not talked about this much. But the actions of the current administration is clear. At one point Trump even said that he did not care about the stock market. His main aim was to reduce the 10 year yield to reduce the interest burden of the burgeoning debt. The Trump’s economic team have repeatedly put pressure on the Federal reserve to cut rates. The hope is that if they can cut the fed funds rate aggressively, then the yield on the 10 year will also follow. To this end he has also put in Mr.Miran in the FOMC policy team and he has been calling for a 300 basis point cut in the interest rates. Now if the can keep the 10 year below the inflation, then over a period of time, the debt will be inflated away. This is has been done before in the 1970’s following the end of the 2nd world war.

At the end of the second world war, both UK and US had high debt to GDP ratios. Over the next 3 decades, high inflation and lower yields was the norm and the debt to GDP ratios came down dramatically. We are currently in the middle of a similar round of negative real rates.

2.Stock market and housing inflation:

The idea here is to create conditions conducive for stocks and housing prices to gain. This will give an illusion of wealth for the people who own stocks and housing. A recent survey put nearly 42% of US households have their savings in the stock market. Although housing inflation has not been there because of higher rates, if Trump can manage to reduce the interest rates, then this could spark another round of house price rises. Between April 2025 to October 2025, $15 trillion has been added to the US equity market. This will increase the financial component of the US GDP and in a way reduces the overall Debt GDP ratio. Another important consideration is that the US government gets 3-6% of its income from capital gains taxes. However during years where the stock market has done exceptionally well, then the capital gains take could reach upto 10% of the total revenue. So certainly good for Trump’s cause. Also as the financial sector is one of the biggest part of the US economy, increasing the Financial sector and circular capital investments in AI are being used to prop up the equity markets. The "Housing Services" component of GDP, which includes both actual rent paid and the imputed rental value of owner-occupied homes, is massive. As house prices rise, so do these imputed values, directly increasing GDP.

3.The role of crypto currencies and stable coins:

Since Trump got elected the Coin market cap has increased by $550 billion. Trump administration has passed the Genius act to make it compulsory to hold US teasuries to back stop these stable coins. The idea here is as the crypto market cap increases, the use of stable coins will also increase and this will increase the demand for the treasuries. Hopefully the treasury would be happy to issue them with lower yielding bonds. So as you can see, both efforts on this front is a way of making regulations that would make it easier for them to sell treasuries to different clientele. This is likely to be a temporary measure until the time for gold revaluation has come

4.Trump’s Ultimate weapon- Gold Revaluation:

The U.S. officially holds ~8,133 metric tonnes of gold—about 261.5 million troy ounces—stored at Fort Knox, West Point, and the Denver Mint (plus custody at the NY Fed). On the government’s balance sheet, Treasury “gold certificates” issued to the Fed are carried at $42.22/oz, a statutory relic from another era.

Implication: When spot gold trades at several thousand dollars per ounce while the books say $42.22, there’s an enormous unrealized valuation gap. Changing that book value would require legal/legislative action and coordinated accounting between Treasury and the Federal Reserve.

How a revaluation could work in principle

There are several conceptual pathways for this

Statutory reset of the official gold price.

Congress (and/or Treasury under existing authorities) changes the official valuation of gold on the balance sheet—say from $42.22 to a new reference figure closer to market (or a policy target). The revaluation gain would show up as capital (or in a revaluation account) somewhere in the official sector.Treasury issues new “gold certificates” to the Fed at a higher price.

The Fed would book a higher-value asset; Treasury would receive a corresponding credit that—depending on design—could flow to the Exchange Stabilization Fund (ESF) or another vehicle. The aim would be to generate usable fiscal capacity (without net new market borrowing) while keeping monetary control intact.

Caveat: The Fed’s independence and remittance rules matter; you can’t simply “spend” revaluation gains without tripping governance and legal constraints.Create a Gold Revaluation Account (GRA).

Many central banks park valuation gains in a revaluation reserve that cannot be spent like ordinary revenue. A U.S. variant could explicitly limit cash use to debt-management purposes (e.g., collateral, backstopping a bond program) to appease institutional concerns.

What could Trump do with a revaluation?

Two different ways the administration can use the proceeds of the revaluation :

A) Balance-sheet repair / buffer.

Use a portion of the revaluation to strengthen public-sector balance sheets (Treasury + Fed), absorb losses from QE/QT, or reduce reliance on high-coupon issuance at the margin. Think of it as capital relief that buys policy time.

B) Collateralize issuance — “Gold-Backed Treasuries.”

Treasury could issue a tranche of gold-linked or gold-collateralized bonds. The thesis: with gold at the center, investors accept a lower yield versus conventional Treasuries. You’d target reserve managers, SWFs, insurers, and retail in EM that value hard-asset links. This will reduce the overall debt service burden and also frequency with which they have roll over the debt and give them time to sort out the structural issues facing the US which will take decades to fix.

Structure options:

Secured notes: Specific claim on a segregated gold pool (encumbering part of the reserves). This is the most likely option.

Indexed bonds: Coupon/redemption indexed to the gold price (more like a commodity-linked sovereign). We think that this is less likely.

Convertible feature: Option to settle a portion in gold or dollars, at issuer’s choice, to avoid losing the metal in a crisis. Again we think that this is less likely

Historical Precedence:

Well you might wonder that this will never happen and legally might be very difficult. But this happened in 1930’s when president Roosevelt confiscated gold from the population and devlaued the dollar approximately 60%. Here they are doing it in a way where people can participate in the devaluation provided they believe in the thesis. Also there has been no tariffs on gold. So the people in US do not have to pay extra to buy gold. You also have to watch Mr.Bessent interview around the time he was appointed treasury secretary and he said that he was convinced that gold is store of value and points out the chinese government’s policies to encourage the chinese people to buy gold.

Possible timeframe for this revaluation:

Again we are now speculating and some of the assumptions we have made to write this blog can be wrong. It is our view that Trump knows that this is his last term. He will be more worried about his legacy. He would want to think that he was great as a president. His actions suggest that he may be aiming for the Nobel peace prize. With regards to the economy, we think the idea behind the current administration is to try and change the rules of the game when they are still the lead player to their advantage and try and be the dominant player as long as they can. As the players ( USA, G7 countries, China and countries of the global south) are playing an economic game, the winner has to be financially strong. So all the attempts have been to try and reset the debt dynamics and try and reshore critical manufacturing to USA. Also unless the Republicans get majority in both the houses, they can not enact all of the changes that they want to do. So we speculate that it would have to be a few months before next year’s november elections. So the latest in our view would be in June 2026. This resetting of gold will enable Trump to show to the people that the economy is getting better and that the debt problem has been managed effectively. It will also allow him to have the fiscal room for giving a tax rebate particularly for the low income groups.

How high must gold climb for Trump’s strategy to work:

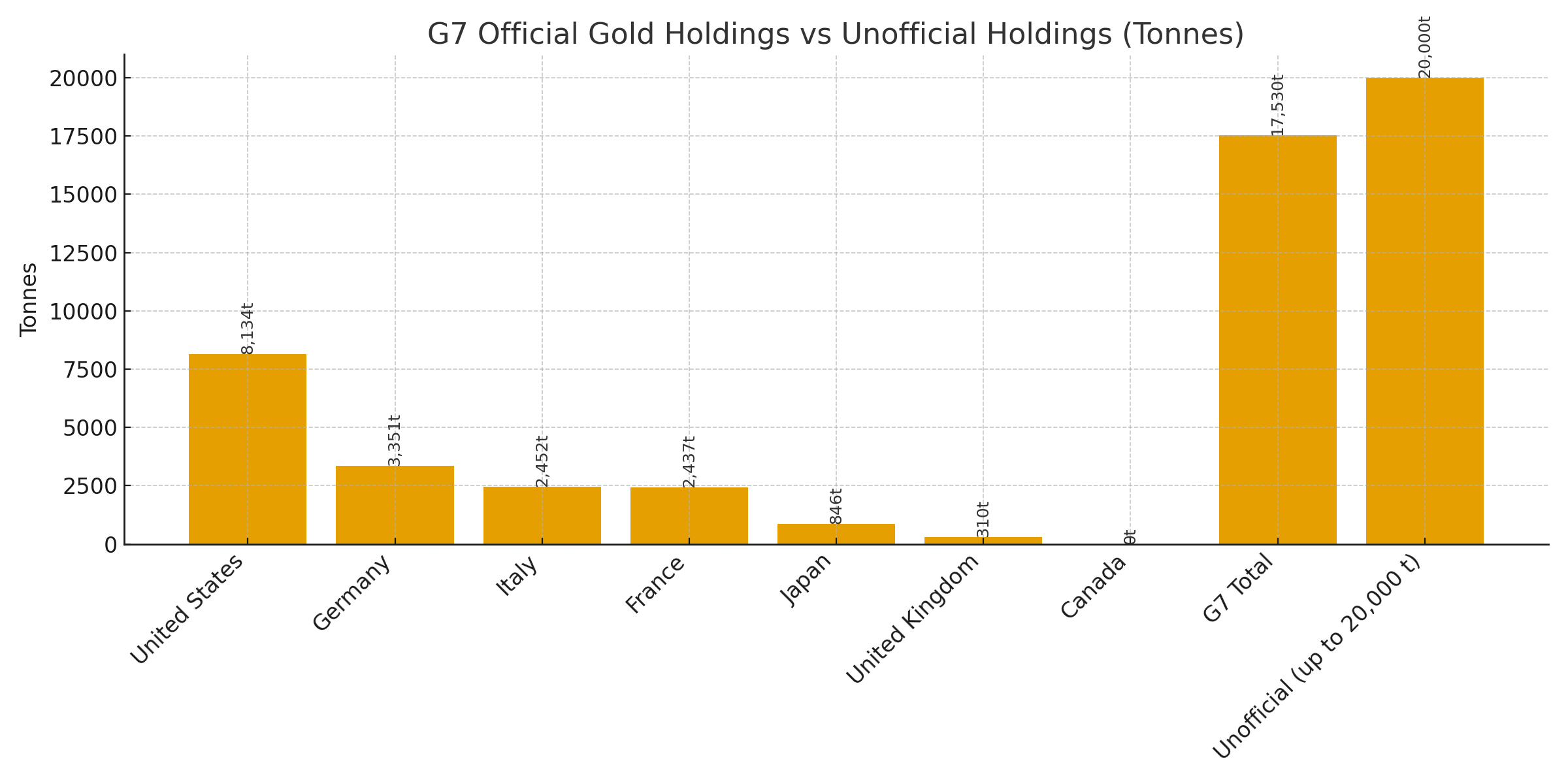

Let’s do some maths. I am not very good at this and so i will keep it very simple. The US needs to refinance more than $9 trillion in debt. If they can refinance a third of this ie $3 trillion it will give them enough fiscal room to enact the above strategy within the timeframe that would be ideal for Trump. If the US has 261.5million oz of gold, then it needs the gold to go up to around $12000. If you asked Chat GPT to do some maths and ask it how much the gold price needs to go up each trading day for it to reach $12,000 by the end of June2026(8 months). Well you would need gold to rise about 0.6% each day compounded to reach this target. Whether the team can achieve that is not my concern as there are multiple players here. You see China’s unofficial gold holding is about 20,000 tonnes. Below gives the gold tonnage of G7 nations and their total against China’s unofficial gold holdings.

Conclusion:

Again we have done this to build a narrative upon which to frame an investment thesis on gold. However this is highly speculative and there are many assumptions that have been taken and these assumption may be wrong. Also in game theory, the players change and the game changes in a way and so we have to be able to change some of the assumptions when we get information that proves the assumptions to be wrong. That is why at Muffett investments, we are not afraid to be wrong. We are wrong a lot of times. But as long as we are able to accept when we are wrong and change according to the information available, we should do ok. We do this in good faith and this is not investment advice.