A review of the fundamental thesis on gold:

At Muffett investments, we have been bulls on gold from March 2024. Today we are going to review our fundamental bias and see if it still makes sense to keep the bias. In order to do this, we have look at the reasons that underpinned the bias previously. Let’s review each of them one by one.

Loss of purchasing power of the dollar:

The dollar has lost more than 97% of its value over the last 100 years. After President Nixon removed the gold standard the pace of the decline in the purchasing power of the dollar has accelerated. As you can see from the table, the value declined by 50% in 30 years but between 1971 and 1980 gold went from $41 to $800 a 20 fold increase ( A signifcant decline in purchasing power of the dollar) . The reason why this happened was the fact that the western governments were saddled with high debts following the second world war. Then inflation was used to reduce the overall debt burden. Today we have a similar scenario. We have indebted western governments with very high Debt-GDP ratios with ageing populations which means that a similar scenario might play out in the next 10 years similar to the scale of devaluation we saw in the !970’s. . It is also important to remember that back in the 1970’s we did not have unfunded social care and pension liabilities that we are saddled with now. On this basis, all hard assets including real estate and stocks will rise. Real estate tends to be very illiquid meaning that it is harder to move in and out of it. Stocks are very liquid and gold can give us the diversification.

Compared to the 1970’s the debt burden is higher and the G7 countries financial grip over the world is slowly fading. So it is reasonable to assume that we could potentially have a move in gold similar to the 1970’s . A 10 fold increase from $2000( gold broke out from a range) would mean $20,000 gold and a 20 fold increase would mean a $40000 in gold.

Do we know the above scenario will play our for sure? The answer is no. But the price action is pointing towards it. As a portfolio diversifier, we think ath all portfolios should have exposure to gold and gold miners.

A brief review of the price action of gold between 1971 and 1980. After Nixon removed the gold standard, gold price increases 5 fold from $41 to $200. The price then corrects by 50% to $100 and then within a span of 4 years ( 1976 to 1980) the price rises 8 fold from $100 to $850. Now that there is more recognition of the value of gold, we think that gold will be repriced. This can reset some of the debt problems facing Western democracies.

Geopolitical fragmentation and weaponisation of the dollar:

Following the end of the second world war many of the colonial powers were forced to give independence to its colonies. However they maintained their power over the world through a new form of colonialism called the Neocolonialism. The idea here is that whoever controls the money controls the world. The rules of the game were adjusted so that the G7 countries always won. Leaders who are ideologically opposed to this or who do not suit the interests were targets of regime change and sanctions through the dollar reserve system.

The G7 was also able to issue debt at low interest rates to be held as reserve assets to enable trade around the world. This changed after the invasion of Ukraine by Russia. When President Biden weaponised the dollar and seized Russian central bank’s assets, it fundamentally changed the trust in the dollar reserve system. The nations of the global south and China started to diversify into gold. Russia was also able to successfully withstand the sanctions and stablise the Rouble with its Gold. China is also actively promoting the use of Yuan backed by gold. Although it might take many years, the tariff barriers which will be raised by the G7 nations would gradually promote the dedollarisation of the global south and in its place gold may be used as a way of settling transactions between nations.

The above chart illustrates the price of gold following the Russian invasion of Ukraine. The price initially spiked followed by a move down. This is most likely due to Russia selling some of its gold reserves to stabilise the Rouble. Then G7 imposes a cap on the price of Russian oil and also imposed sanctions on Russian elites. This is the reason why the price of gold started to break out and then caught the attention of global investment community.

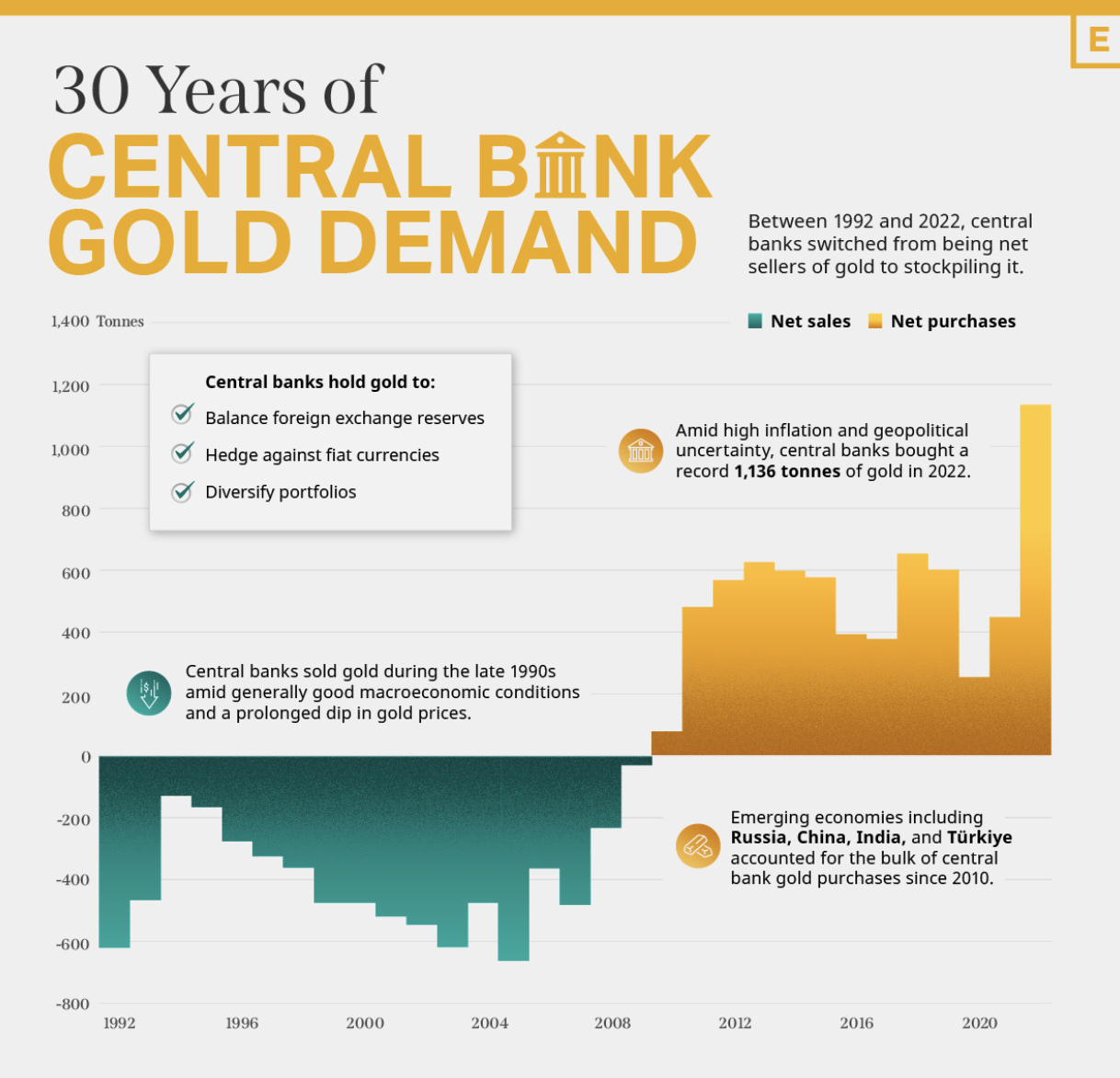

Central banks accumulated more than 1000 tonnes a year from 2022 onwards. We think that with increasing geopolitical fragmentation into two different trading blocs, the central bank buying of gold will increase as other central banks look to increasingly diversify some of their reserves into gold to backstop their currency to enable trade without the need to use US dollars.

Another significant development is the slow erosion of the petrodollar status of the US dollar. China now buys most of its oil from Middle east and Russia using Yuan. The Shangai gold exchange plans to open a Gold vault in Saudi Arabia and this enables the Yuan to be converted into gold. China has also forced BHP one of the largest iron ore miners to sell part of their iron ore that they export to china in Yuan India and Russia are also doing some of their trade using Rupees and Rouble. There was an estimated $68 billion in trade between Russia and India of which 90% were settled in local currency without using the US dollar.

Another bad news for the dollar would be the trade between China and the rest of the World eclipses that of USA and rest of the world. If china were to ever want to de-dollarise, then it can easily do so and undermine the US dollar reserve status and a collapse in the value of the US dollar against gold.

source- Visual capitalist.

ETF flows:

In an interview Scott Bessent, the American treasury secretary said that the Chinese government enforces capital controls on their population but are encouraging its citizens to buy gold. Flows into Chinese Gold ETFs have been steady. In contrast in the US, there was a net flow out of gold. But this surged in 2025 as shown in the chart. We think that this will continue and will underpin the price of gold.