The investment case for the Aussie dollar:

Many portfolio managers do not look at currencies in their allocation of capital. Many of them are also limited by the restrictions on holding certain types of assets. For example an US focussed fund must allocate all their capital to US listed stocks. But for retail investors and for Muffett investments, these restrictions do not apply. This is a key advantage for retail investors as we do not have any restrictions placed on the type of investments that we can make. Now why should we look into currencies you may ask. There are two reasons for this. One is the rising debt of most of the G7 nations as well as many developing countries. When servicing the debt becomes unsustainable, the governments would resort to financial repression ( Keeping the real interest rates lower than inflation) This would mean the value of the currency will degrade over time. This is one of the main reasons why UK investors and some of the EU investors should consider investing in countries with lower Debt-GDP ratio. Countries with low debt to GPD ratios are less likely to implement financial repression. Australia is one of the countries with low debt to GDP ratio and is also a western liberal democracy. The second is the fact that in our view, the Australian dollar is undervalued against several countries including UK and Switzerland. So diversifying our investments into assets linked to Australian dollar would mean that the money is to a certain extent protected against financial repression and if Australian dollar were to appreciate against the GBP and Swiss Franc, then our overall returns will be magnified.

Today we present a macro analytical view on the Australian dollar. We feel that it is one of the few structural safe havens in world full of countries with fiscal instability and a changing geopolitical landscape.

Good day! A short note on Australia:

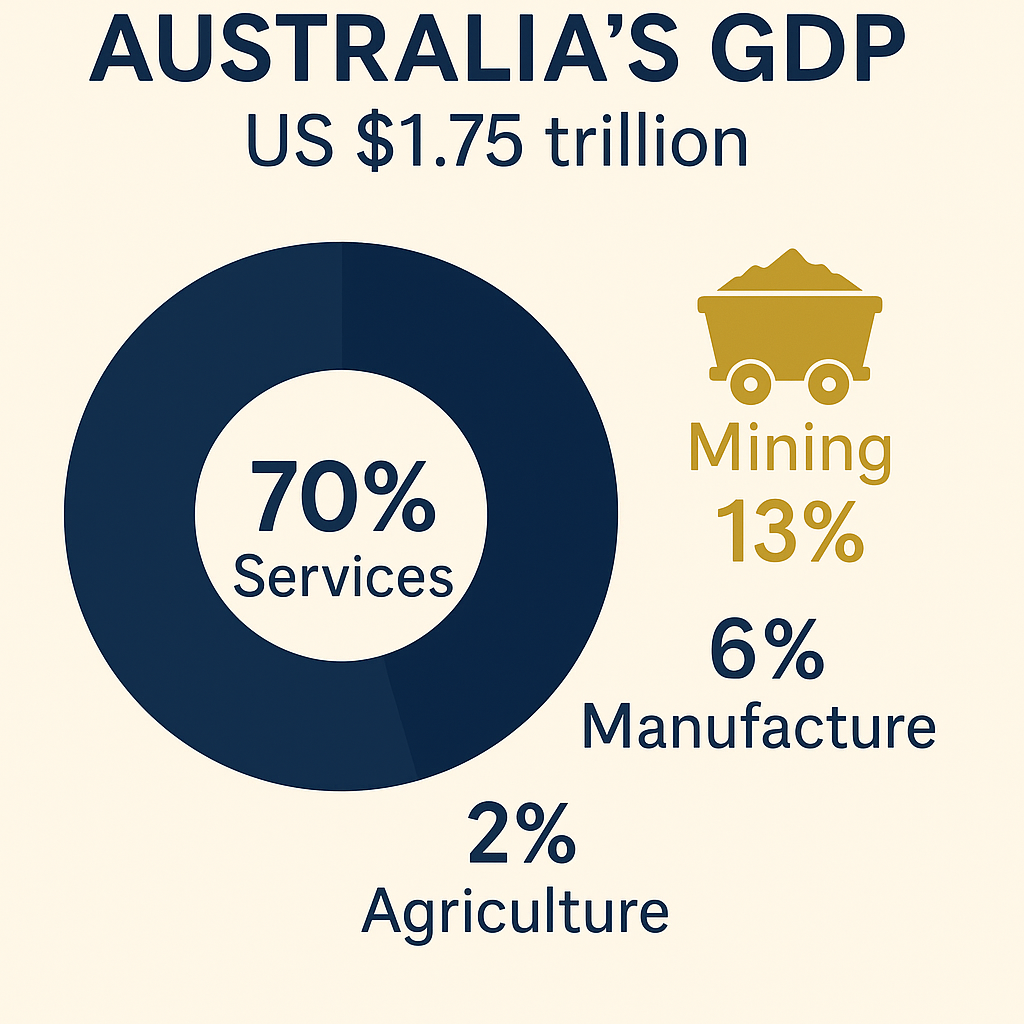

Australia is the 6th largest country in the world with a population density of 4 people/Km2. The GDP is of Australia is $1.75 trillion and is the 13th largest in the world with an annual growth rate of 1.8%. The median age of the population is 38 years. The above image shows the distribution of the GDP across different sectors. The per capita GDP of Australia is higher than that of the UK.

Trade surplus and current account strength:

Source- Reserve Bank of Australia

For most of the post war period, Australia ran a persistent current account deficit but this trend reversed decisively in the last decade. Exports have outpaced imports since 2019, and the trade balance has surged to over 4% of GDP, driven by energy and resource exports. This shift reflects the structural rise in resource exports and reduced dependency on foreign capital. Very few western democracies with low debt - GDP ratio can boast such a current account surplus.

Australia is a commodity superpower:

Source- Reserve Bank of Australia

As you can see from the composition of exports, Australia’s main export is resources including Iron ore, Oil and Gas, Coal, Gold and critical minerals. From a low of about 12% in the 1960’s, resource exports now account for nearly 60% of the total exports. Most of these exports are directed towards the fast growing Asian economies mostly China, the ASEAN countries and India.

1. Iron Ore — Australia is the world’s largest exporter, supplying over 35% of global seaborne trade, primarily to China, Japan, and South Korea.

2. Natural Gas (LNG) — Australia rivals Qatar and the U.S. as one of the top three LNG exporters, with rising demand from Asia’s data centre and industrial expansion.

3. Gold — Australia is the number 2 producer of gold after China. As the price of gold rises, the value of the gold exported will increase

4. Critical Minerals — Lithium, cobalt, and nickel exports are rising rapidly, aligning Australia with the global energy transition.

Source- Reserve Bank of Australia

Low debt to GDP means low risk of financial repression:

One of the main reasons to have exposure to the Australian dollar, is the country’s low debt to GDP ratio and this external debt is falling over recent years. This means that the Australian government is less likely to engage in financial repression. Already there is evidence in the UK that suggest that Financial repression is starting to take shape. Diversifying into Australian assets ( real estate, Land, Stocks) would protect these assets from losing their value over time but it can potentially also mean an appreciation against GBP denominated assets. Even low risk bets yielding low dividends will over time give better returns as the Australian dollar appreciates against other currencies that will engage in financial repression.

With stronger fiscal metrics and higher nominal yields than Japan or the Eurozone, Australia offers one of the few positive real yield environments in the developed world — a key reason the Australian dollar will remain fundamentally supported.

Exposure to Asian growth:

Have a look at the growth rates of China, India, Indonesia and Philippines over the last 15 years. These large asian economies are growing at a rate double that of many western economies. The large populations of these countries mean that economic growth in these regions would lead to increased demand for commodities. Australia is in close proximity to these nations and able to export these at a lower cost. In fact 80% of all commodity exports from Australia go to these countries. This is also one of the most convincing reasons to have exposure to Australian dollar as it will give us exposure to the Asian growth. In the future over the next 20 years the economic output of this region will eclipse that of the west and there will be a shift of economic power from the west to the east.

Commodities that will underpin the Aussie dollar:

Iron ore and coal will contribute less in the next few years and replaced by Gold, Copper and Lithium. As we expect the value of gold to increase, gold exports may become the top export category in the next few years. A $20,000 gold will mean the total gold exports will exceed $200 billion.

Technical analysis:

We are going to look at 2 charts. GBPAUD and AUSUSD

The above is the weekly chart of GBPAUD. I have a very keen interest on this pair as i live in the UK. If we look at the long term chart going over the last 20 years you will see that the GBP has been falling against the Aussie dollar over time. But in the last few years price has been in a broad range as shown by the range high and range low. Within the range a short term high was taken out( liquidity purge) . Price is now falling. We think that it is very likely that price will test the lower end of the range. This may take several years but we are in an investment trade not a short term trade and the investing horizon should be longer.

Above is the weekly chart of AUDUSD. We think that there is scope of big appreciation of the Aussie dollar against the US dollar. But as you can see from the chart, the price has been in consolidation for a long time. There is liquidity below which will be taken before the move higher. So at Muffett investments we are waiting for the price to come to the Buyzone to initiate long term positions on the Aussie dollar against the US dollar. we showcase the trade in our model portfolio

we hope that you found this insightful. Please comment on linkedin about your thoughts on this idea.

Disclaimer: The above article is for educational and research purposes only and is not investment advice.