A strategic analysis of Nasdaq from an investor perspective- 2026

Here we present an analysis of Nasdaq from a portfolio manager’s perspective with a view to outperform passive investment. This could be useful for individual investors who manage their own personal portfolios as well. The big idea here is that every year there is usually 2 opportunities to gain an edge in alpha compared to passive investing. To gain that edge we need to have a portion of the portfolio in cash and then we wait for the market makers to do a liquidity run. This could be in the form of move below a low of a quarter or a monthly low. The above chart is the daily chart of Nasdaq with the last 2 quarters of 2025 marked. It also shows the liquidity pools of the quarters which are the highs and lows. The green shaded area is our best buy zone which is a previous high and we have not tested that yet( please refer to previous analysis).

One of our premises that we will be operating on, is the fact that Trump will want a strong Nasdaq heading into the November midterm election. So within reasonable probability outcomes( we have to consider scenarios which Trump has no control ), the markets will be higher by the time of the November election. So if this were to be true, and if we do have a liquidity run earlier in the year, that would be the best time to enter leading stocks that are out performing the indices. If we were to use this strategy we can easily beat the performance of passive. At Muffett investment we are expecting much higher volatility this year similar to the time around liberation day last year. If we focus on megatrends and be patient then we can generate alpha.

The above is the weekly chart of Nasdaq and we have the weekly EMA drawn. The price is in strong uptrend as it has not touched the 20 week EMA since it broke out. If you look back, you can see the 20 EMA and the 50 EMA are excellent areas to go long on the Nasdaq. So we will be watching if Nasdaq can touch any of the EMA. The 50 ema is a much better opportunity.

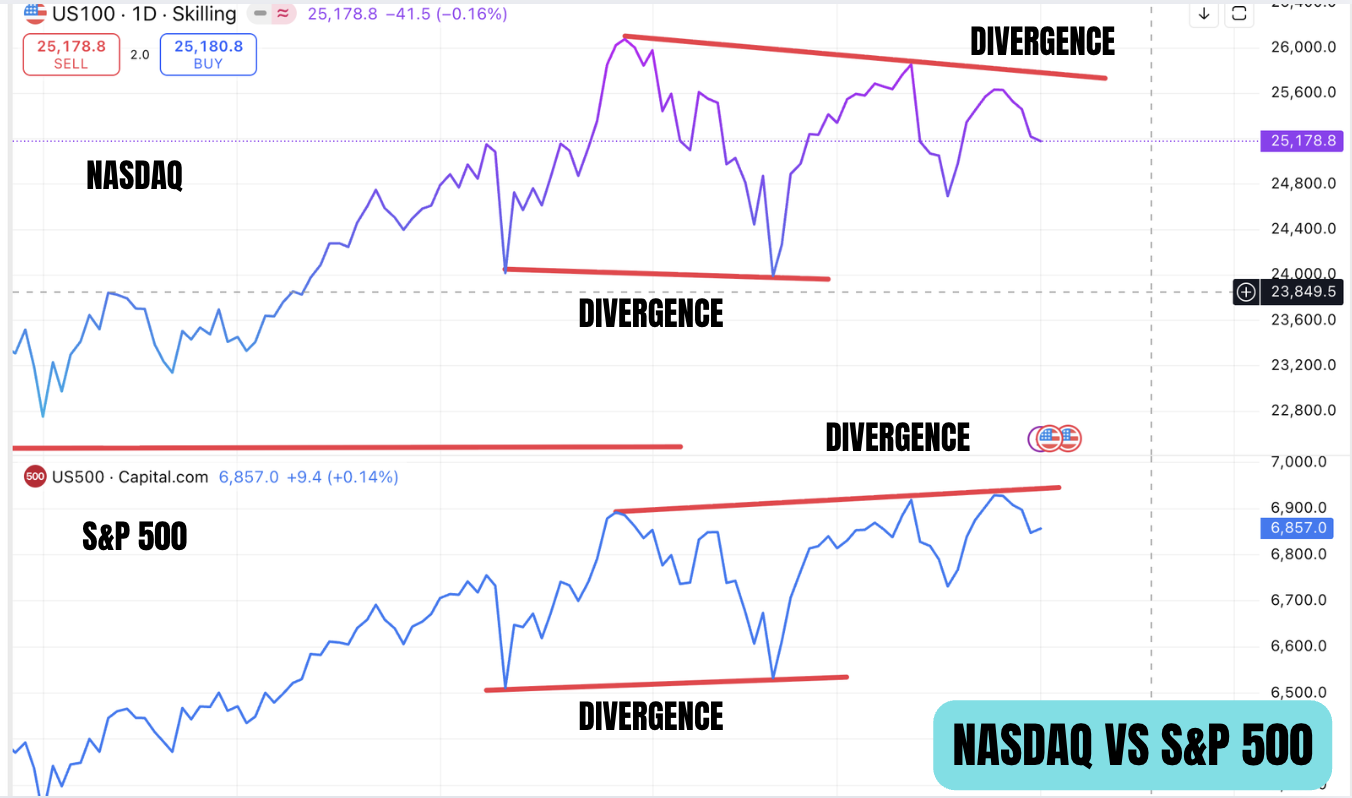

The above chart compares the Nasdaq with the S&P 500. We can see divergence at top and bottom and so we need to wait for this to be resolved one way or the other. We are looking for a move lower before we deploy the cash on the side lines. We have to be patient and not be FOMO into deploying the cash. Our edge as retail traders resides on the fact that there is no limitations to how much cash we can have at any point of time and where the capital is deployed. And we need this edge together with the idea shared above to beat passive investing.

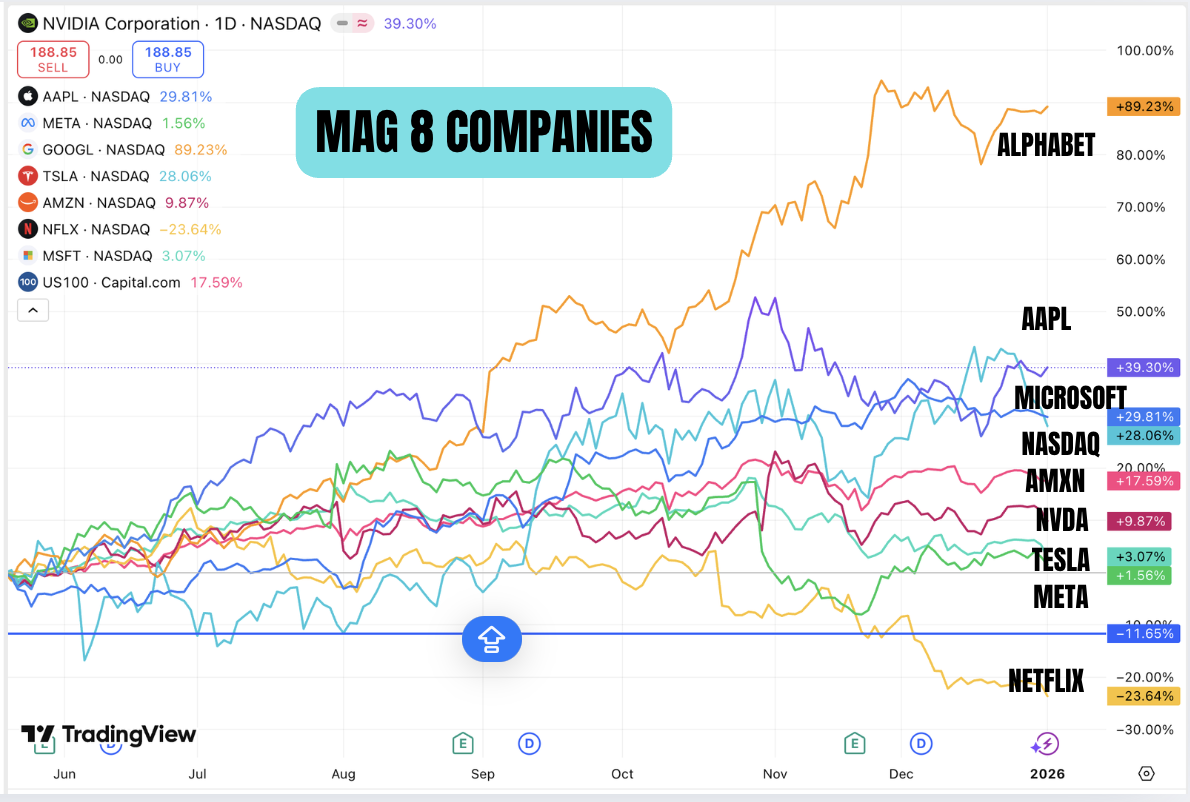

Finally we look at the MAG 8 companies. These are the mega caps with the ability to move higher. So if we need to see rallies on the Nasdaq, we have to see rallies in these companies. Currently only Microsoft, Apple and Alphabet are showing relative strength and it looks like Microsoft closed below the Nasdaq line due to yesterday’s weakness. This does not bode well for higher markets. So we think that the markets might go lower first to take out liquidity before the move higher.

May the peace of the Lord be with you all

Disclaimer: The above blog is Muffett’s own views and is for educational purposes only and does not constitute as investment advice.