The investment case for Nestle:

We have been watching Nestle with interest. We have considered Nestle in the past but have excluded that because of its large debt. The stock has however sold off and we have done further research on Nestle and we have come to a conclusion that maybe Nestle may be at an attractive valuation. We have initated a small position on Nestle with a view to add to the position if Nestle shares were to sell off.

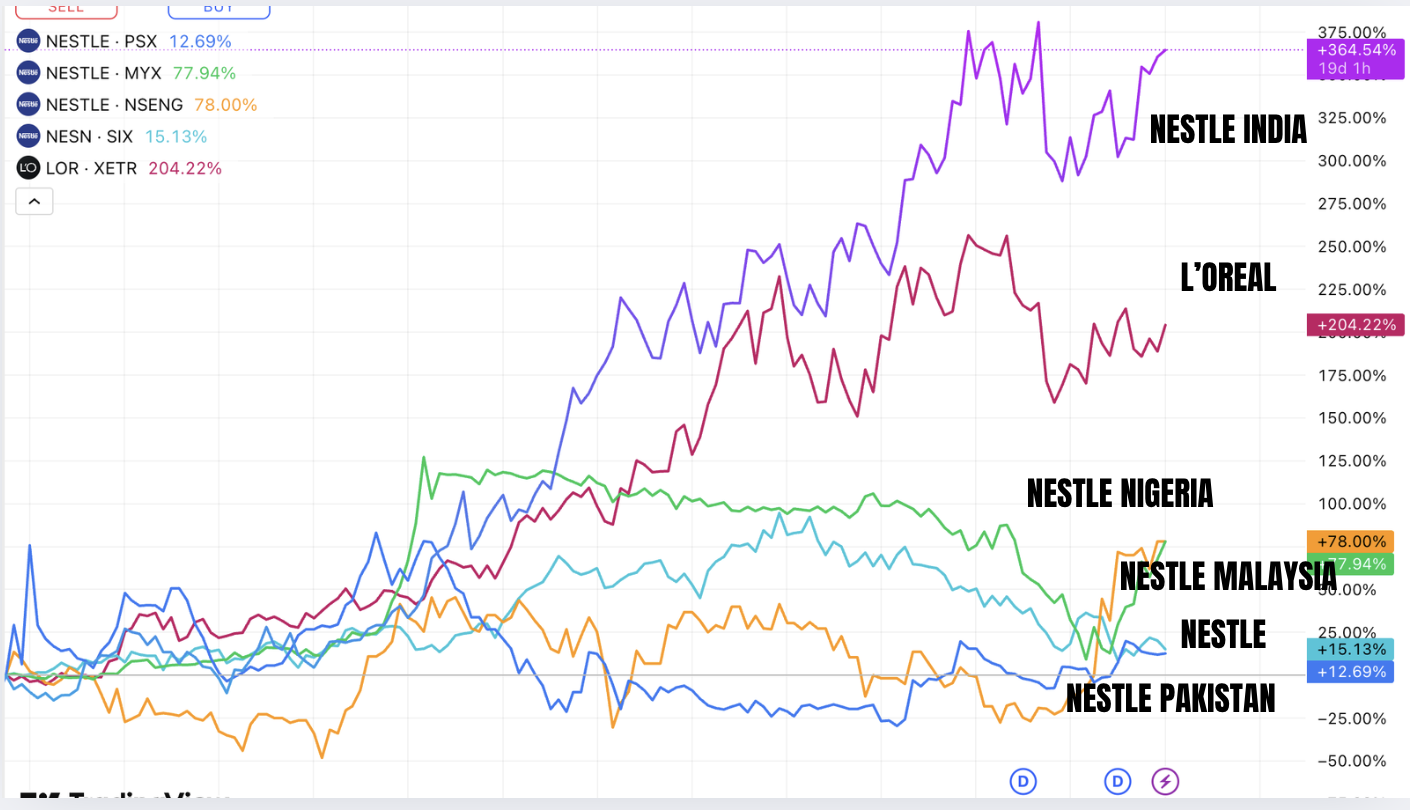

If you look at our 2026 investment series we have an investment idea which seeks to participate in the megatrend of African and Indian growth. We think that Nestle is one of the companies which will benefit from this. Did you know that Nestle is listed in the local stock markets in the important markets of India, Malaysia and Nigeria. Nestle owns 60-70% of the shares and so when we value the Nestle shares, we have to take into consideration its ownership of L’oreal and the ownership of the Nestle shares in these emerging markets. We want to share a chart which compares the Nestle shares with the shares of the stocks that it owns.

This is a chart comparing Nestle with that of its subsidiaries in important emerging markets and L’Oreal in which it holds 20% stake. Apart from Nestle Pakistan all the others are showing relative strength compared to Nestle. This suggests that not only is the value of these stakes are rising but it also indicates at the local level the shares are considered to be good value.

As the affluence of India and Africa grows, from their demographic dividend, commodities price rises and their holding of Gold ( India) we think that they will be consuming more of Nestle’s products. And this is the basis of our investment thesis on Nestle. For example we like the fact that Indian households hold about 25,000 tonnes of gold as savings. As the price of gold increases, then the value of their gold holdings will icnrease proportionally and this wealth effect will cause them to increase their spending in luxury good. This is a megatrend as we predict the continued rise of gold and silver as the debt of the western government increases. At current gold prices, the Indian households hold about 3.5 trillion dollars of gold. At $10,000 which is a conservative prediction at Muffett investments, the value of the gold holdings would be about 8 trillion dollars. Also many of the African countries will benefit from increasing commodity prices and as the affluence of the population increases they will use more of Nestle’s products.

One of the big risks for Nestle would be rising inflation as they may find it difficult to pass on the increased cost to the consumer. But at the end of the day, they may have to raise prices and in a way they focus on the essential necessities of living and so in a way they are relatively protected.

Also almost half of the debt is denominated in US dollars and as the dollar loses its value in Swiss Franc terms. Let’s have a quick look at the USDCHF chart.

Over the last 7 years, the dollar has lost about 20% of its value in Swiss Franc terms. This means that the value of the debt taken by Nestle would be proportionally reduced. Also the management has taken active steps to reduce costs and headcount. So the benefits of these measures would be seen next year.

This is the income statement from Nestle. Their revenue has been static for the last 5 years. But we should take into consideration that we were in a huge inflationary wave between 2020 to 2022. This has affected their revenues as the discretionary spending is cut back. But as we have poitned out earlier, as the affluence of India and Africa continues to grow, Nestle should show increasing revenues especially as they are taking steps to cut spending.

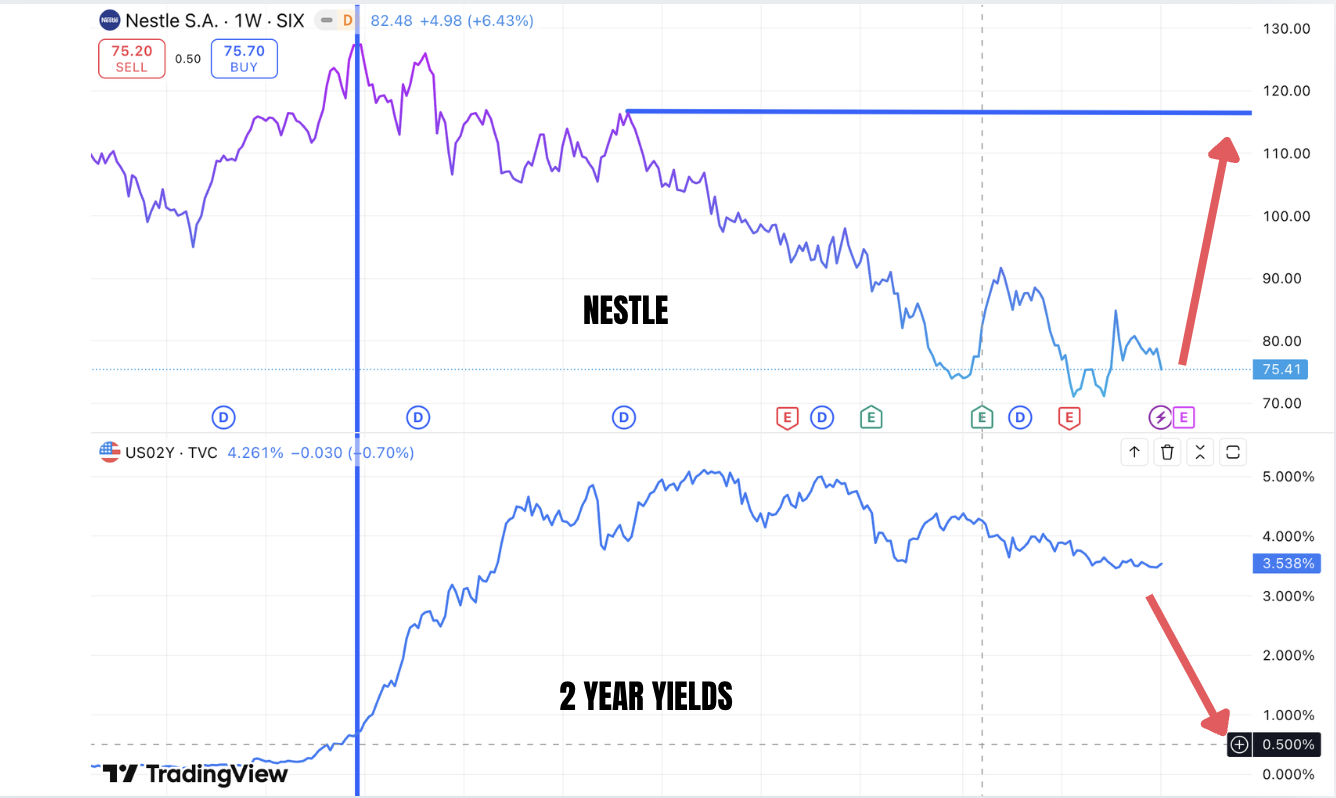

Finally Nestle shares are very sensitive to the yields. The above chart shows the shares of Nestle at the top and the 2 year yields which is a proxy for the fed funds rate. As the yields started to rise, the Nestle shares have started to fall . Now that the Yields are falling and we are sure that Trump will succeed in reducing the short term rates, the falling yields will have positive effect on Nestle share price.

We think that Nestle is at an attractive valuation( prices are near 2018 level) relative to the overall markets and there are some positive headwinds which will cause the price to rise in our view. As suggested earlier, we suggest that to add Nestle shares in small increments and add to the positions if Nestle shares were to fall.

Disclaimer: Analysis done in good faith and is not investment advice. The above is for information purposes only and documenting what we are doing in our own portfolio. May the peace of the Lord be with you always.