Will Alamos gold start to outperform?

Investment research from Muffett investments- 16/01/2026

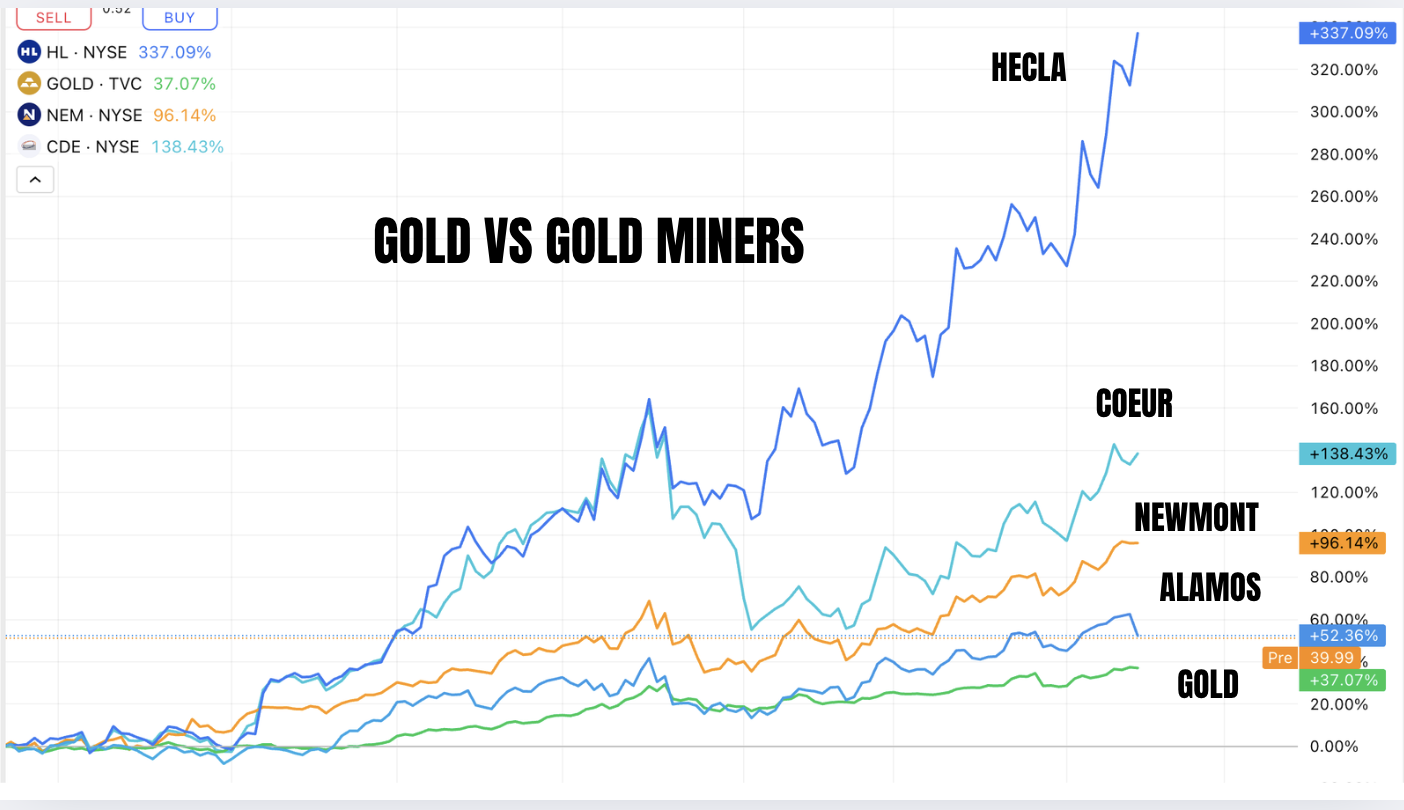

`The above chart compares the performance of gold vs gold miners. The miners we are comparing are the ones that we like at Muffett investments. As you can see Alamos gold is one of the miners which is showing the least relative performance compared to other miners. We at Muffett investments however believe that in the coming months and years, Alamos has potential to increase revenue and in that way will show outperformance compared to other miners. So for investors with no previous exposure to gold, can consider Alamos gold.

Source- Google finance.

As of today, the share price is trading at $56 canadian. The market cap is 23.5 billion dollars.

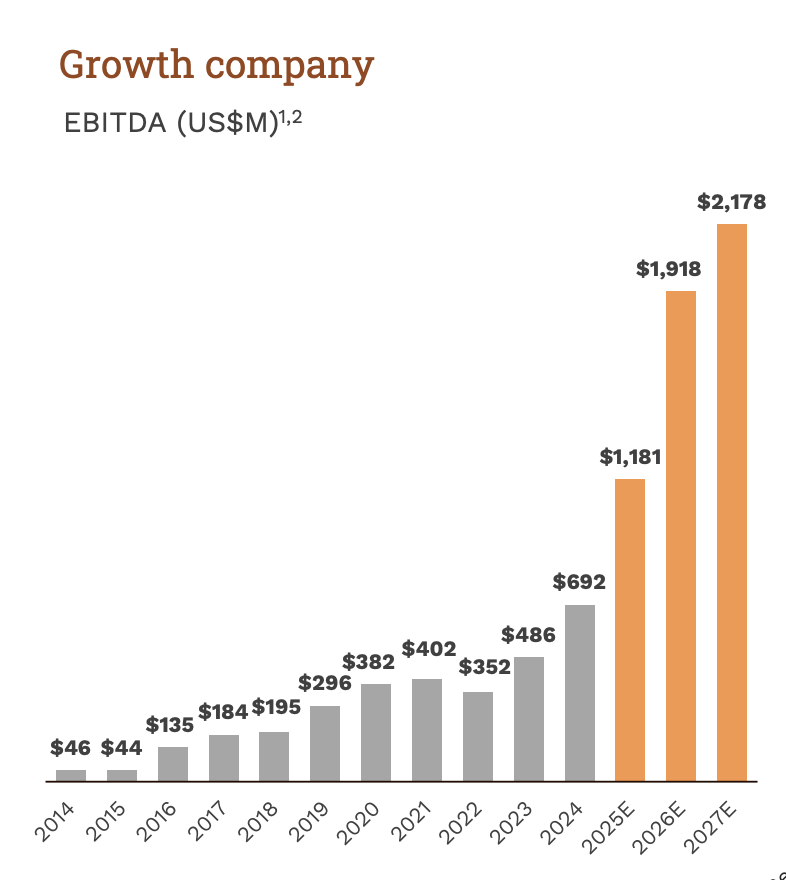

Alamos is an amazing growth story. They have grown their EBIDTA from $46 million to $1.1 billion in 2025. Their expected EBIDTA in 2027 is $2.1 billion which is almost 50% above this years total. They have 4 operating mines, 3 in canada and one in Mexico. All these locations are in geopolitically stable locations which reduces the risk of mining related disputes.

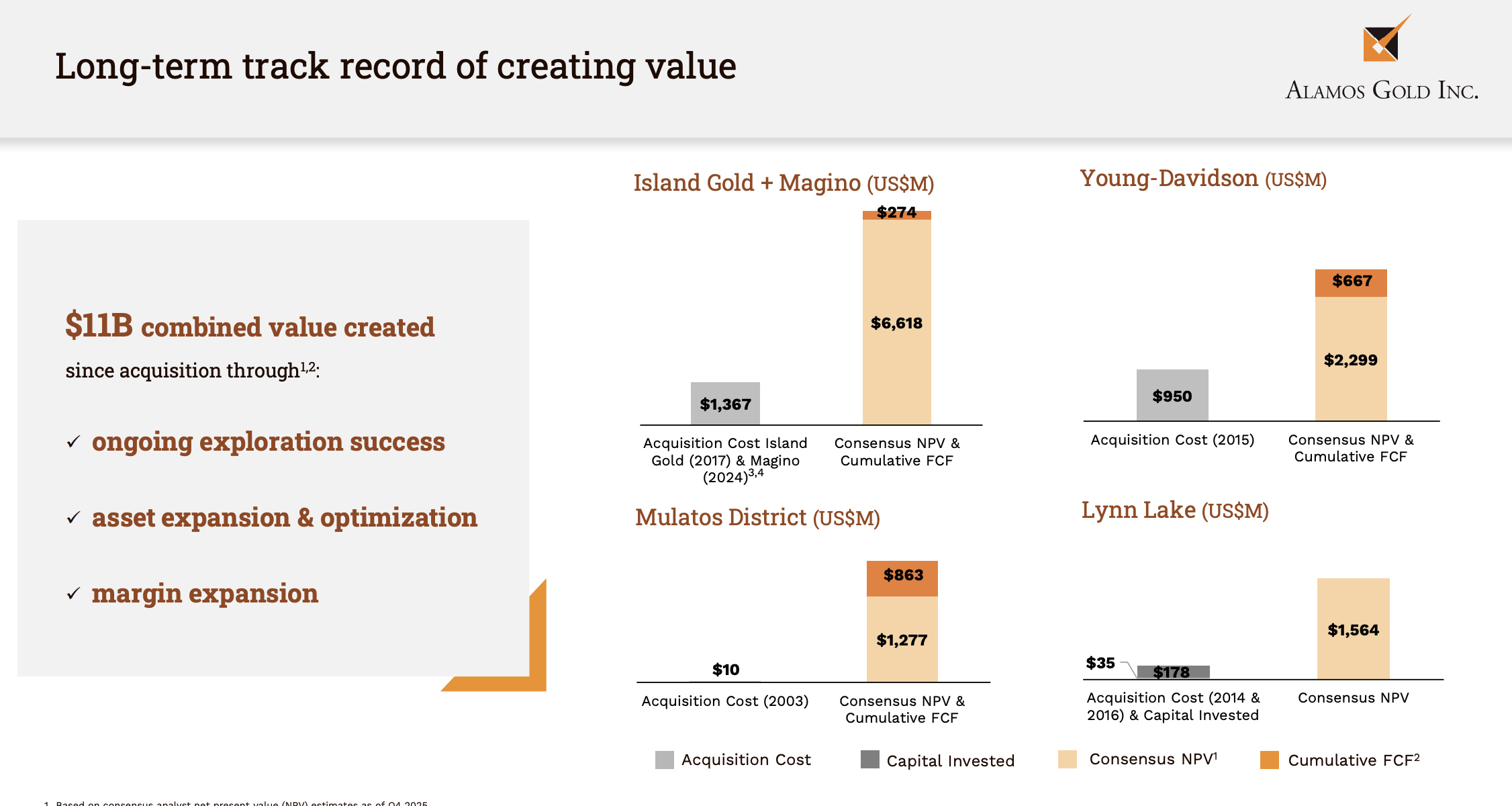

They pride themselves in value creation. They famously acquired a mine for $10 dollars at the bottom of the gold cycle. Through exploration and margin expansion, the net present value of the mine is now $1.3 billion with free cashflow of $863 million. They have created $11 billion in value through acquisition, exploration and asset optimisation.

Source- Alamos investor presentation

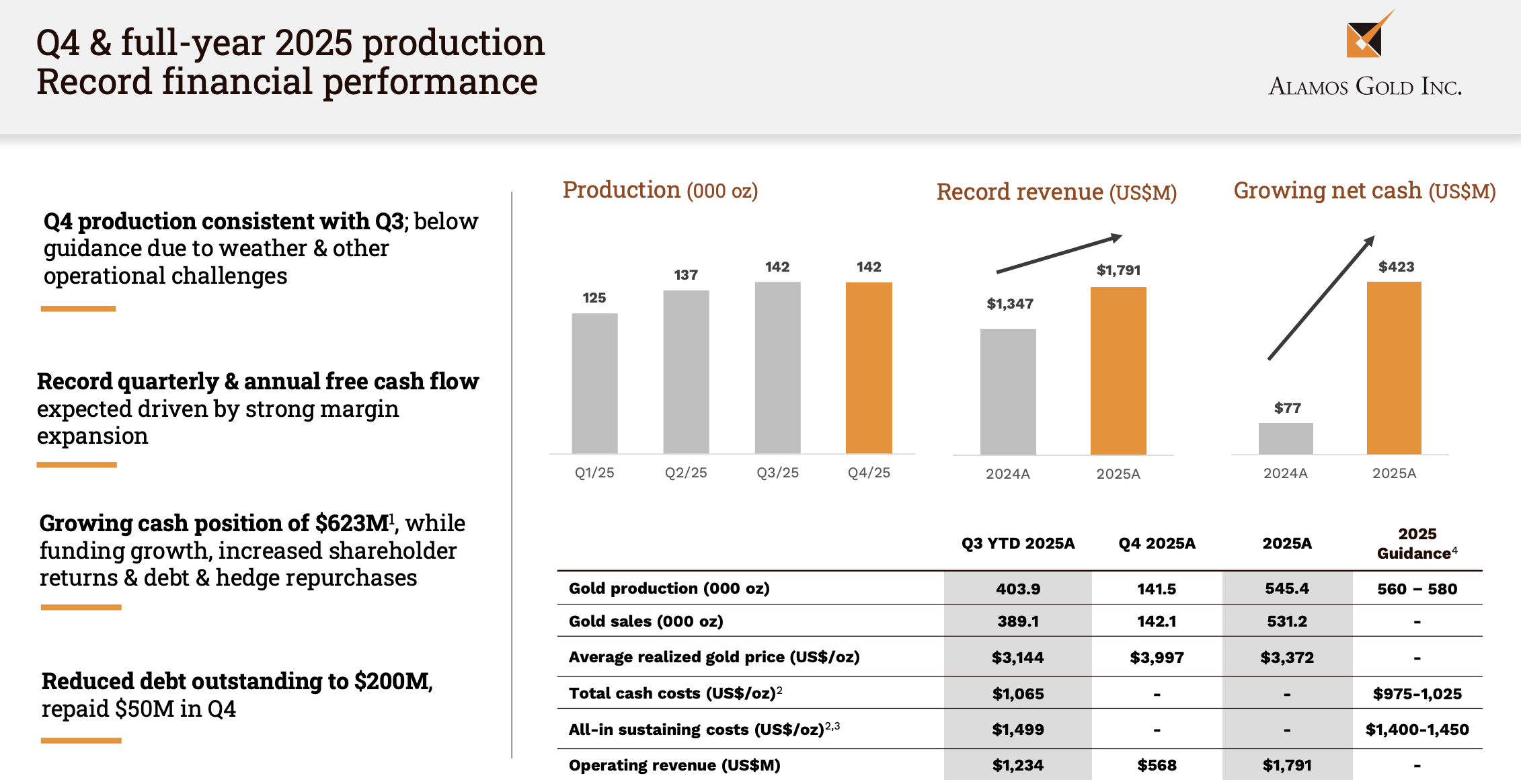

They maintained record quarterly and annual revenues even though production was below guidance due the weather conditions. They have a net cash position of $423 million and their all in sustaining cost for gold production is about $ 1500. This is expected to fall to $1200 when production ramps up in 2027.

Source- Alamos investor presentation

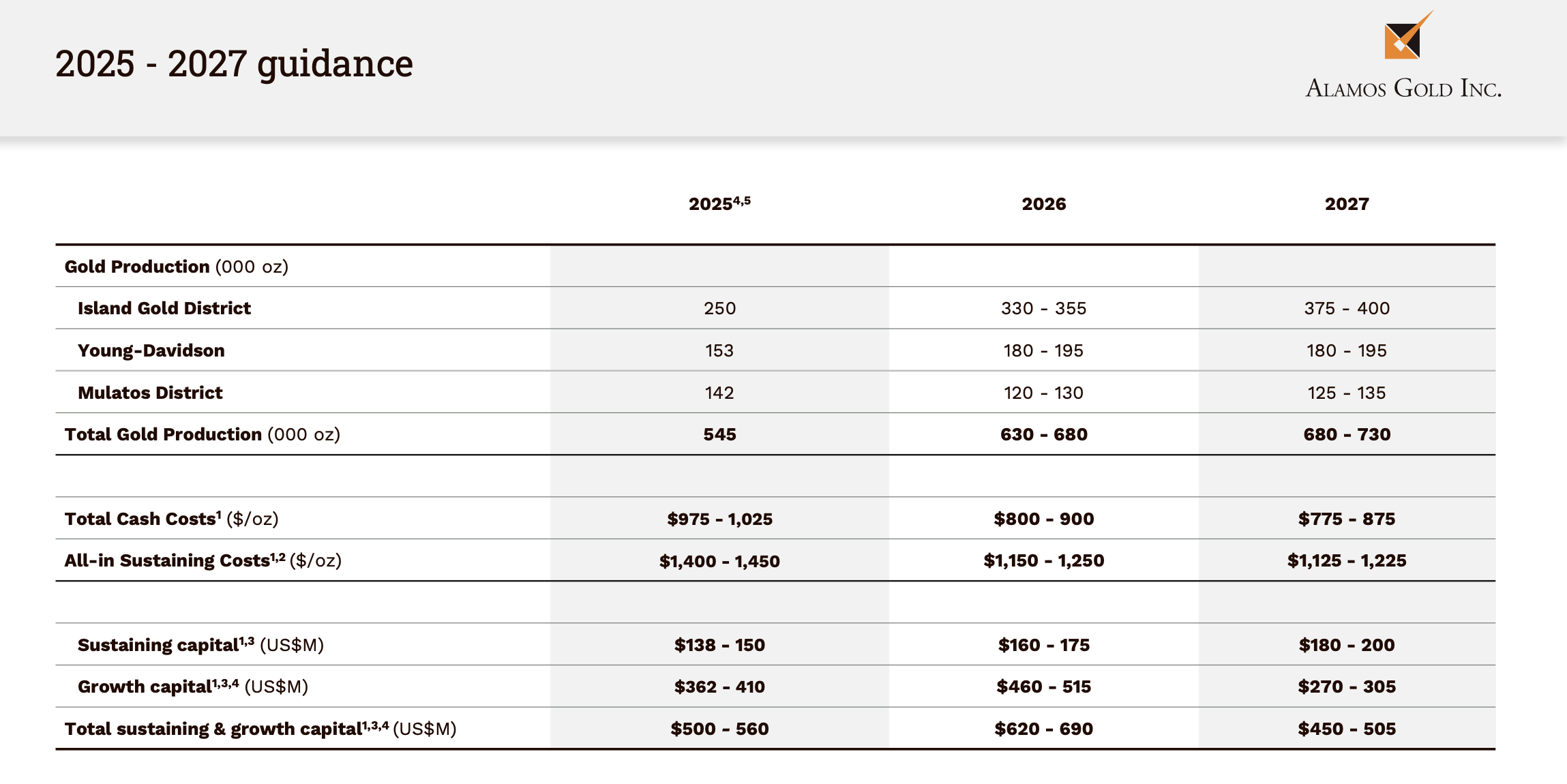

According to the guidance given by the company, gold production would increase from 545000 oz in 2025 to about 700000 oz in 2027. This would be a 25% increase in gold production together with a decrease in production costs by another 20%. Both should result in atleast a 40% improvement in revenues. If gold price were to be higher like we are expecting in 2027, then the revenues can be expected to be even higher.

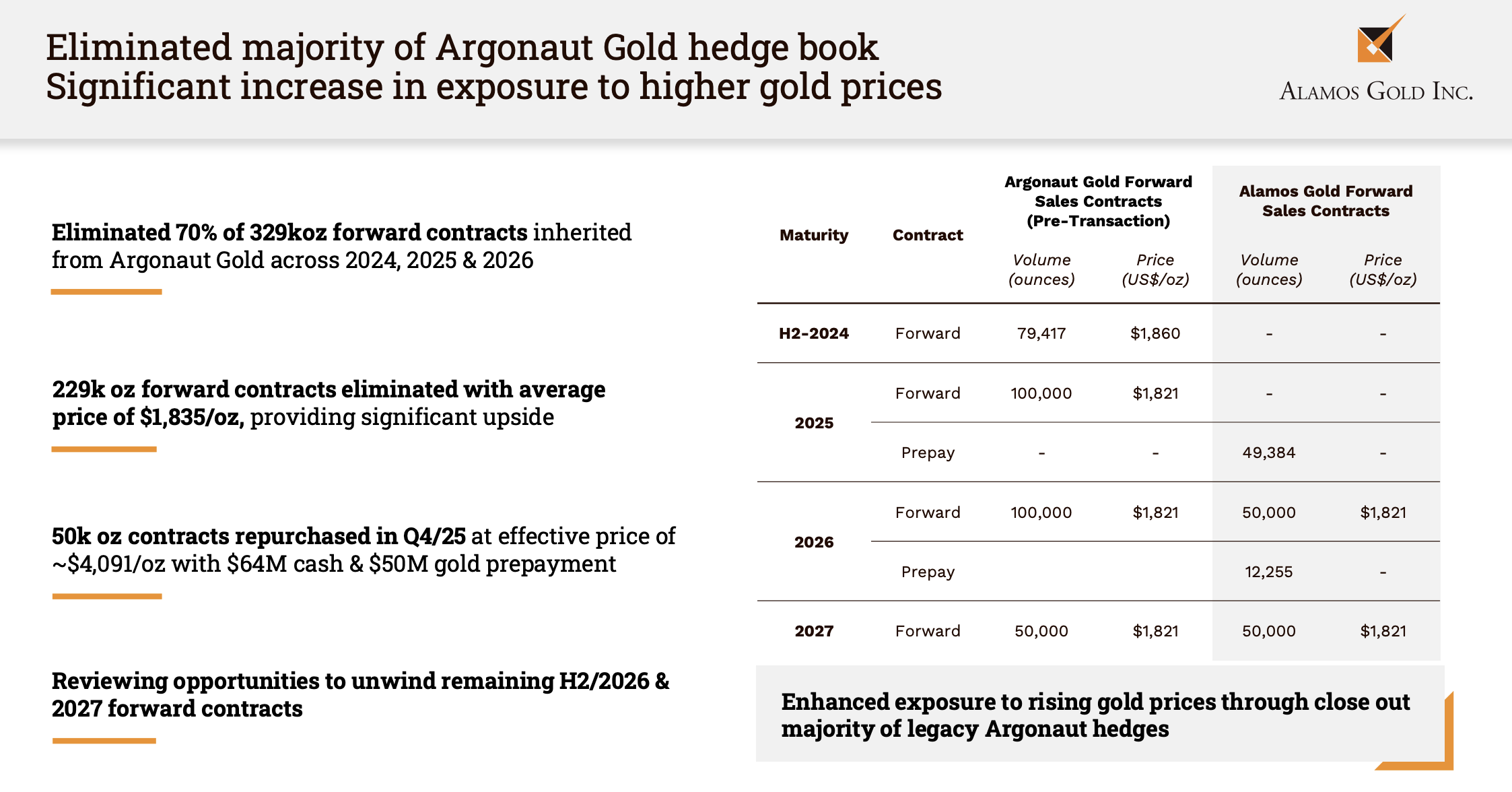

This is one of the main reasons why Alamos gold has not performed well compared to the peers. When they acquried Argonaut gold, they had to take on hedges taken by Argonaut gold. They have however closed 70%hedges and so we expect increased revenue as the hedges were taken when gold was around $1800.

In summary, there are many tailwinds for this company. If you are convinced on the investment case for gold, then Alamos gold is one company to consider.

Disclaimer: The analysis is done in good faith and not investment advise. These are our own views and this does not constitute investment advice. May Lord God bless you and heep.