Nasdaq analysis 17/01/2026:

We want you to refer to our previous analysis on Nasdaq. This is the link for this. https://www.muffettinvestments.com/market-analysis/a-strategic-analysis-of-nasdaq-from-an-investor-perspective-2026.

The above chart is comparing Nasdaq with S&P 500 and GBPUSD. We have taken GBPUSD as a risk asset and weakness in GBPUSD suggest a possible move to the downside for the indices. This is intermarket relationship that many do not know. The S&P 500 has made higher highs while the Nasdaq and GBPUSD has made a lower high. To us it suggest manipulation and the technology stocks are being distributed. It is also important to understand that divergence means nothing until it is confirmed by price action. So we are on the look out for a sudden move to the down side to take out liquidity. If this happens, it shakes out the weak hands and provides the market makers orders for them to enter into long positions. So at Muffett investments we are waiting.

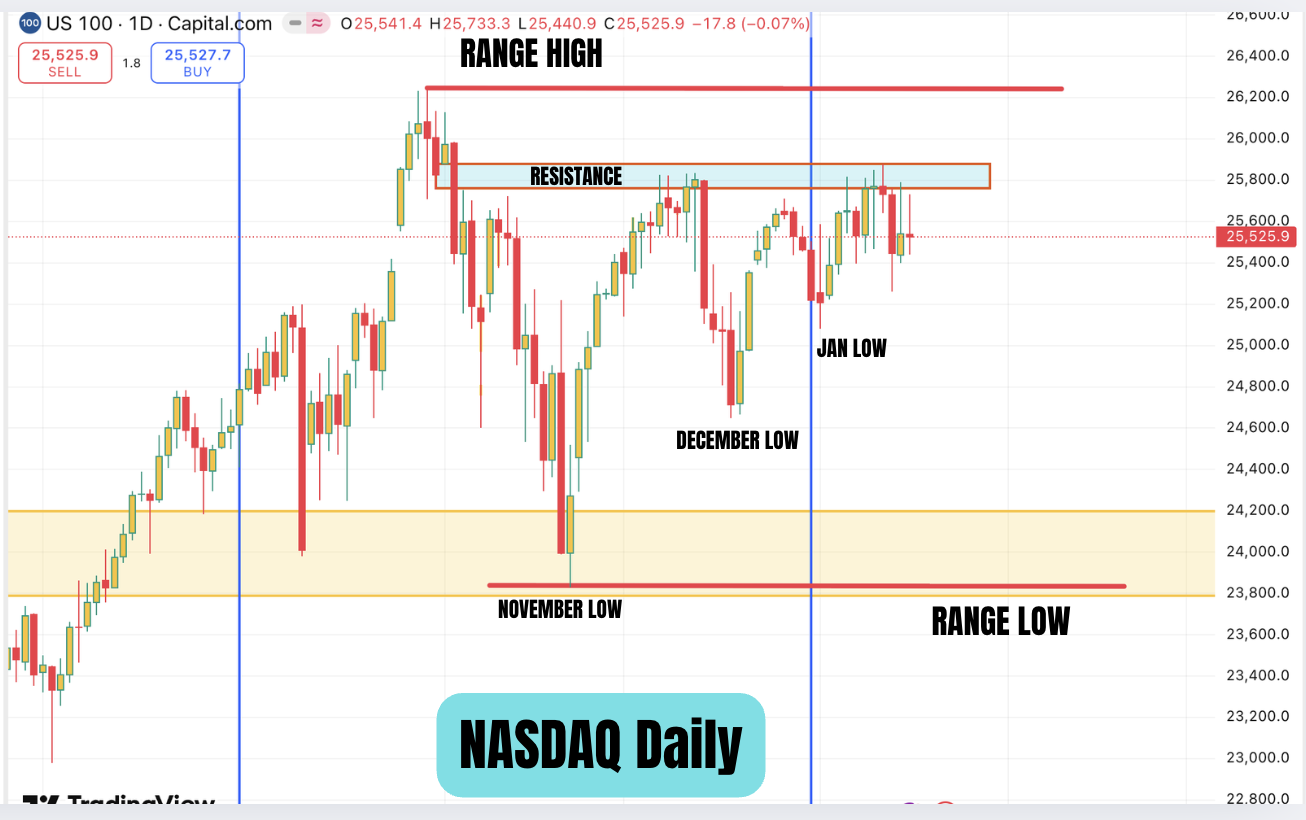

The above is the daily chart of Nasdaq. We have the resistance zone marked and until price can close above this, we are on the look out for a liquidity run. We have identified the points of liquidity and marked them as Jan low, december low and November low. In our view the most likely target will be a run on the December low. But if we have a war in the middle east, then the November low could also be a target. If we look at what US is trying to do, it is very clear that action on Iran is being planned. More Aircraft carriers are being moved to the middle east. The time window is also narrow. Trump would want a very quick war like they did in Venezuela. This will help him negotiate with China when he visits in April .whether or not he will achieve what he wants remains to be seen.

If the price closes above the resistance, then we can see new all time highs. So although we have raised cash in our portfolio, we will re-deploy them if this were to happen.

The 4 hour trend is already down and if price were to close below 25200, then the daily will become bearish and then we are very likely to target at least one of the liquidity targets identified above.

Because i have set the Lord at my right hand, I shall fear no harm for he will be by my side and protect me. May peace be with you all.

Disclaimer: Analysis done in good faith and not investment advice. The opinions in the blog are Muffett’s own ideas and strategy and does not constitute investment advice. Please do your own research.