Collapse of confidence in money- How Gold Exploded From $100 (1976) to $850 (Jan 1980)

Event Timeline (1971–1980)

Aug 1971: Nixon ends dollar-gold convertibility (Bretton Woods ends).

1973–74: Oil embargo; global inflation accelerates.

Mid-1976: Gold troughs near ~$100/oz.

1978–79: Iran Revolution & Hostage Crisis; dollar wobbles.

Dec 1979: USSR invades Afghanistan; safe-haven panic.

Jan 1980: Gold peaks ~$850/oz; Volcker’s tightening crushes inflation psychology.

We present the chart which shows the price action of gold between 1970 to 1980. As we all know in 1971, Nixon took the dollar off the gold standard. We are not going to delve into the reasons as to why he went off the gold standard nor are we going to go into the wisdom behind this. The point we are trying to illustrate here is the fact that in 1971 gold was trading at $41 and by 1980 gold reached a high of $850 an astonishing 2000% increase in a decade. The more dramatic increase happened between August 1976 to February 1980 where gold went from $100. to $800 and eightfold increase. When we look back at the gold move in the 1970’s, then this current move in gold wont be surprising and we argue here that the current move in gold has not only started.

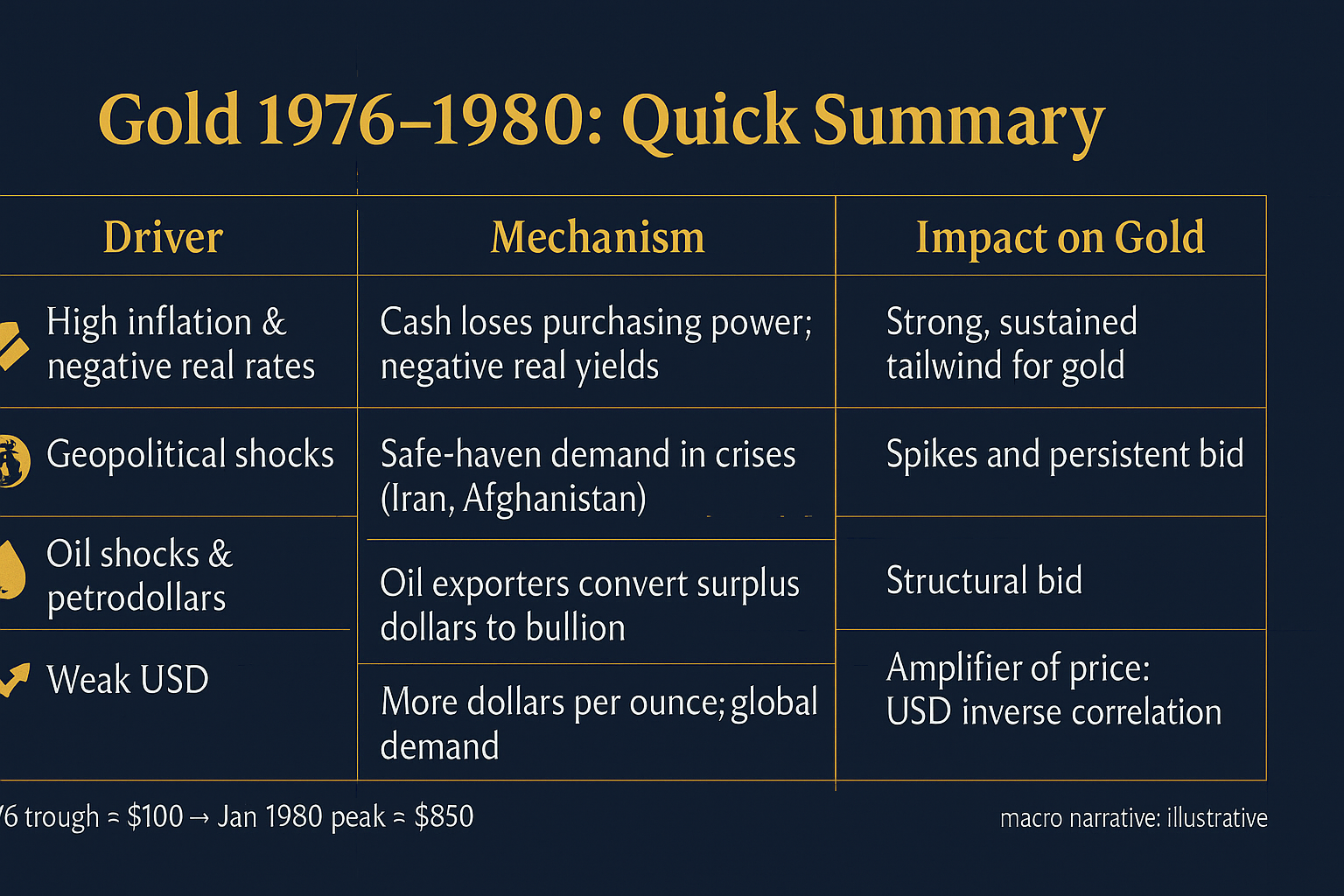

Here is a detailed breakdown of the key drivers:

1. The Great Inflation

This was the fundamental bedrock of the gold boom. The 1970s were defined by "stagflation"—a toxic combination of stagnant economic growth and high inflation that conventional economic theory said couldn't happen.

The Legacy of Loose Monetary Policy: The U.S. had funded the Vietnam War and Great Society programs in the 1960s without commensurate tax increases, effectively "printing money." This sowed the seeds of inflation.

The End of the Gold Standard (1971): President Nixon's decision to sever the U.S. dollar's convertibility to gold (the "Nixon Shock") removed the primary anchor of the global monetary system. Currencies were now free-floating, and their value was based purely on faith. This faith was rapidly eroding.

Rampant Inflation Erodes Wealth: By the late 1970s, U.S. inflation was in the double digits, peaking at 13.5% in 1980. When the value of cash in your pocket is melting away, people rush to buy real things that hold their value. Gold, as a timeless store of value with no counterparty risk, became the ultimate refuge.

2. Geopolitical Turmoil and the "Cold War" Fear Factor

A series of major geopolitical crises created a climate of deep uncertainty, driving investors to the ultimate safe-haven asset.

The Iranian Revolution (1978-79): The overthrow of the Shah of Iran created massive instability in a key oil-producing region.

The Iran Hostage Crisis (1979-81): The seizure of the U.S. embassy in Tehran humiliated the United States and fueled fears of a wider conflict.

The Soviet Invasion of Afghanistan (December 1979): This event marked a dramatic escalation of the Cold War, raising fears of a direct superpower confrontation.

3. The Oil Price Shocks and Petrodollar Recycling

Oil and gold have a famously strong correlation, and the 1970s were the quintessential example.

OPEC Oil Embargo (1973) and the 1979 Energy Crisis: These events caused the price of oil to skyrocket. Oil-producing nations, particularly in the Middle East, were suddenly flooded with U.S. dollars ("petrodollars").

Recycling into Gold: Fearful that their massive dollar holdings were losing value to inflation, these oil-exporting countries began converting a significant portion of their windfall into gold, creating massive, sustained buying pressure.

4. Weakness in the U.S. Dollar

As the world's reserve currency, the dollar's weakness is inherently bullish for gold.

A "Paper Currency Crisis": The combination of high inflation, political instability (exemplified by the Iran crisis), and a perception of weak U.S. leadership led to a severe lack of confidence in the dollar.

Dollar Index Decline: The U.S. Dollar Index (DXY), which measures the dollar against a basket of other currencies, fell sharply during this period. When the dollar weakens, it takes more dollars to buy an ounce of gold, pushing the price higher.

The Untold Story: Why France & Switzerland Wanted Their Gold Back in the 1970s

Today, we hear about countries like Germany repatriating their gold, but this is not a new phenomenon. The original "gold recall" happened in the late 1960s and 1970s, led by two European nations: France and Switzerland. Their motivation wasn't just financial; it was a dramatic vote of no confidence in the global monetary system, orchestrated by two formidable figures: French President Charles de Gaulle and his financial guru, Jacques Rueff.

The System They Challenged: Bretton Woods

After World War II, the Bretton Woods system made the U.S. dollar the world's reserve currency. Crucially, every other currency was pegged to the dollar, and the dollar itself was pegged to gold at $35 per ounce. Other nations could, in theory, exchange their dollar reserves for gold from the U.S. Treasury.

De Gaulle's "War on the Dollar"

By the 1960s, a major flaw emerged. To fund the Vietnam War and domestic programs, the U.S. was printing more dollars than it could back with gold. This created an "exorbitant privilege," allowing America to buy up foreign assets and run deficits simply by exporting its own paper currency.

President de Gaulle saw this as a form of financial imperialism. In a famous 1965 press conference, he declared economic war, announcing that France would immediately begin exchanging its massive dollar reserves for gold, ship-by-ship.

His reasons were clear:

Restore the Classical Gold Standard: De Gaulle and Rueff were economic traditionalists. They believed a true gold standard was the only path to discipline, stability, and national sovereignty.

Check American Power: This was a deliberate move to challenge U.S. hegemony and force fiscal discipline upon Washington.

Protect National Wealth: With inflation rising, they feared the dollar would be devalued, eroding the value of France's reserves. Physical gold in the Banque de France's vaults was the ultimate safe haven.

Switzerland's Quiet Follow-Through

Switzerland, always a bastion of monetary prudence, watched closely. While less politically motivated than France, the Swiss shared the core concern: the dollar was becoming overvalued and risky.

In the early 1970s, the Swiss National Bank (SNB) also began converting a portion of its dollar reserves into gold. For Switzerland, it was a straightforward risk-management decision. They saw the same writing on the wall as de Gaulle—the Bretton Woods system was cracking—and moved to protect the value of the franc.

When we look at the current situation, we had Russia invading Ukraine in february 2022. Immediately, the G7 imposed severe sanction on Russia and also in a extraordinary measure, the assets of Russian central bank was frozen. We call this the weaponisation of the dollar and this started the loss of confidence in the dollar. Immediately after the depegging of the dollar, the gold price was moving up but gradually and the price even fell after a few years. But a combination of high inflation and Geopolitics accelerated the move and in a 4 year period gold went up 800%. so we should not be surprised by the current move in gold. And infact maybe we should prepare ourselves for a much bigger move next year. As a trader, we assess the price action at each point of time and see if our fundamental bias matches the technical price action. If both align, then we can take longs on gold and gold miners. I hope this post was insightful. Anything can happen at anytime. our job should be to identify these big moves and ride them. May peace be with you all