TWO NATURAL GAS STOCKS FOR THE COMING LNG BOOM

*Muffett Investments - September 2025*

The natural gas market is at a pivotal inflection point. After a period of subdued prices, the fundamental setup for a sustained rally is strengthening, driven by structural demand growth that is just beginning to hit its stride. For investors, this creates a compelling opportunity, and within the space, two names stand out: the sheer scale of EQT Corporation and the premium-leveraged model of Antero Resources.

This analysis breaks down the bullish catalysts, provides a head-to-head company comparison, and details the specific LNG projects that will fuel this multi-year growth story.

Why Natural Gas Prices Are Poised for a Structural Rebound

The case for rising natural gas prices rests on four powerful, concurrent demand drivers:

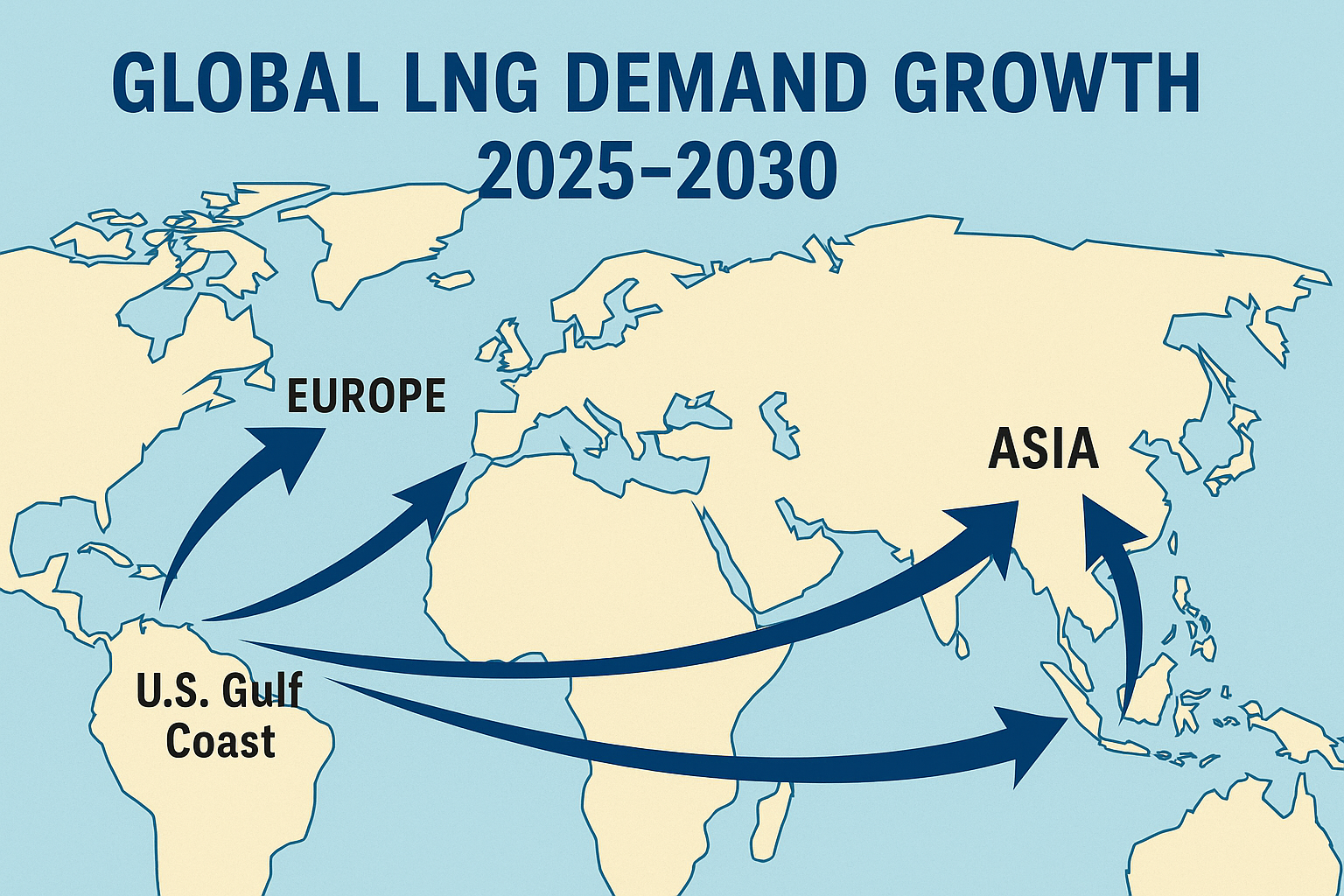

The Unstoppable U.S. LNG Export Wave: The United States is entering its "second wave" of LNG expansion. With an estimated 8-10 Billion cubic feet per day (Bcf/d) of new capacity slated to come online between 2025 and 2030, the U.S. is solidifying its role as the world's gas station. This represents a massive new source of demand that will steadily tighten the domestic market.

Insatiable Global Demand: Europe's pivot away from Russian pipeline gas is permanent, locking in long-term demand for U.S. LNG. Simultaneously, Asia—led by China, India, Japan, and South Korea—is aggressively building regasification terminals to secure supply for power generation and industrial growth.

The AI Power Drain: The explosive growth of Artificial Intelligence and hyperscale data centers is driving record power demand. Natural gas, with its reliability and ability to dispatch power 24/7, is the indispensable partner to intermittent renewables, ensuring grid stability.

Resilient Domestic Demand: This isn't just an export story. New gas-fired power plants within the U.S., like the facility EQT has secured offtake for, highlight that domestic consumption is also on the rise.

The LNG Buildout: A Project-by-Project Guide (2025-2030)

The following projects are the concrete pillars supporting the bullish thesis. This isn't speculation; these are largely FID-approved (Final Investment Decision) projects under construction.

Project NameLocationCapacity (Bcf/d)Expected StartKey DevelopersPlaquemines LNG (Ph 1)Louisiana~1.02025-2026Venture GlobalGolden Pass LNGTexas~2.52025-2026ExxonMobil / QatarEnergyCorpus Christi Stage 3Texas~1.02025-2026Cheniere EnergyPort Arthur LNG (Ph 1)Texas~1.52026-2027Sempra / ConocoPhillipsRio Grande LNG (Ph 1)Texas~1.52026-2027NextDecadeLake Charles LNGLouisiana~1.52027-2028Energy TransferPlaquemines LNG (Ph 2)Louisiana~1.02028+Venture GlobalOther Projects (CP2, etc.)Gulf Coast~2.0+2028-2030Various

Cumulative Impact: This buildout represents a ~40-50% increase from current U.S. LNG export capacity. This tidal wave of new demand will fundamentally reshape the North American gas market.

Company Showdown: EQT vs. Antero Resources

So, who is best positioned to capitalize? Let's compare the two leaders.

1. Earnings & Cash Flow Profile

EQT Corporation (The Scale Player):

In Q2 2025, EQT demonstrated its cash flow resilience, generating $1.03B in Adjusted EBITDA and $240M in Free Cash Flow, even after absorbing a significant one-time litigation expense.

Its strength lies in its integrated model and cost discipline, with per-unit costs held to a low $1.08/Mcfe. It realized an average price of $2.81/Mcfe.

Antero Resources (The Premium Play):

Antero boasts a unique, liquids-rich portfolio, with over 50% of its 2024 revenue derived from NGLs. This provides a valuable, differentiated revenue stream when NGL prices are strong.

Crucially, it has the highest exposure to the LNG corridor among its peers, with 75% of its gas delivered via firm transport to premium-priced Gulf Coast markets. Its 2024 average realized gas price was $2.20/Mcf (unhedged).

Takeaway: EQT offers consistent, scaled cash flow. Antero offers torque to premium gas prices and a built-in hedge via NGLs.

2. Growth Outlook & Leverage

EQT (Optimizing the Behemoth):

EQT is focused on operational excellence, recently boosting production guidance while cutting capital expenditures.

Its growth is supplemented by strategic M&A (like the Olympus acquisition), adding incremental scale and synergies.

Antero Resources (The Pure Torque Play):

Antero is a story of capital efficiency and direct exposure. It has slashed drilling costs by ~30% since 2023 and is perfectly positioned to capture the full benefit of rising Gulf Coast LNG prices.

With analysts forecasting NGL price premiums in the second half of 2025, Antero's revenue could see a significant uplift.

Takeaway: EQT grows by getting bigger and more efficient. Antero grows its cash flow by getting more from each dollar spent and having direct line-of-sight to the best markets.

3. Balance Sheet Strength

EQT (Aggressive De-leveraging):

EQT carries a higher absolute debt load, with $7.8B in net debt as of Q2 2025. However, it is on a clear path to reduction, having repaid $4.3B in 2024 and targeting a $5B net debt goal by the end of 2025. Its scale supports this leverage.

Antero Resources (Lean and Stable):

Antero operates with a lower-leverage model, focused on generating free cash flow without the burden of a massive debt overhang. It maintains strong liquidity and has no major refinancing risks until late 2026.

Takeaway: EQT is a story of successful de-leveraging, while Antero is a story of sustainable, low-leverage operation.

Investment View: Which is Right for Your Portfolio?

Choose EQT if: You want the benchmark, low-cost producer. It's the ideal vehicle for investors seeking relative stability and steady cash flow generation from the gas sector, benefiting from the rising tide of LNG demand through its massive production scale and integrated midstream assets. It's a "set-it-and-forget-it" gas play.

Choose Antero Resources if: You want maximum torque to the LNG boom and commodity prices. Its premier exposure to the Gulf Coast LNG fairway and its high-margin NGL production make it the prime candidate for outperformance in a bullish price environment. It's for the investor who believes strongly in the specific price differentials strengthening and wants a purer play on the export theme.

Final Thought: The coming LNG capacity boom is a game-changer. Whether through the steady hand of EQT or the agile, leveraged approach of Antero, positioning in high-quality natural gas equities is a strategic move for the next five years.